Life Habits & Investing Principles

No matter how familiar we are with investing, we’ve all navigated uncertainty, weighed risks and rewards, and made carefully considered tradeoff decisions. Just by being human, we’ve been compelled to tackle the central challenges of life—which also happen to be the central challenges of investing. Investing better means living better. Not just because it can lead to having more money, but because many of the habits that serve us well as investors serve us well in life, too. By integrating our life and investment philosophies, we can see money as a tool that empowers our plans rather than as a goal in and of itself.

Our highlight article of the week from Dimensional shares six principles that can help you in life and in investing.

The Reward for Waiting

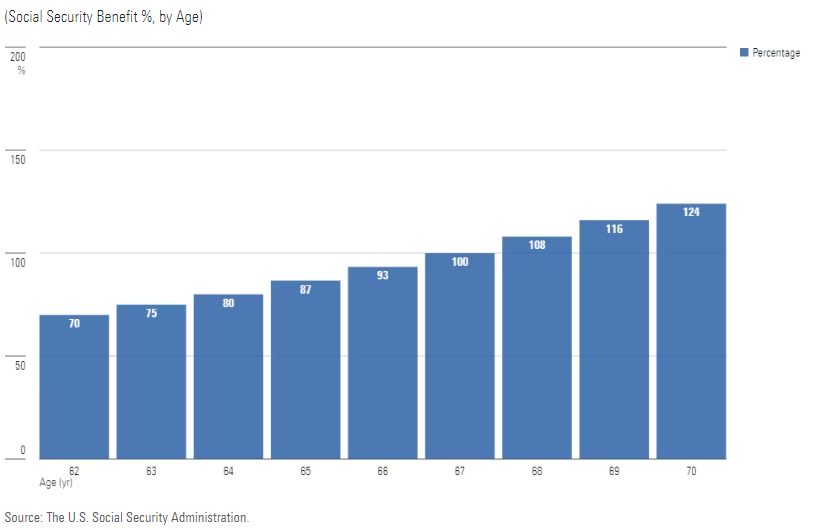

Starting to collect social security benefits at the earliest possible age of 62 provides 70% of the retiree’s earned benefit; delaying to age 67 confers 100%; and postponing until age 70 creates a bonus, boosting the percentage to 124%. These amounts are fixed, save for the inflation adjustment that is applied to all Social Security disbursements. That is, the 62-year-old recipient will collect 70% of the full benefit for the rest of their life, while the retiree who holds out until age 70 will receive 124%.

What it means: Most experts who analyze the Social Security program conclude that retirees should at the least wait until their full benefit age of 67 before receiving Social Security and perhaps delay until age 70. That is a reasonable conclusion. However, the general advice does not apply to all.

Links to What Else We're Reading

Legacy Trust Family Wealth Offices

4200 Marsh Landing Blvd, Suite 100

Jacksonville Beach, FL 32250

Office: (904) 280-9100

Fax: (904) 280-9109

Legacy Trust Family Wealth Offices of Jacksonville Beach, Florida, is a new type of financial services firm - an independent multi-family office - that brings all facets of your personal financial affairs under one roof, where they are coordinated for optimum efficiency and maximum performance.

Investment products are not FDIC insured, are not bank guaranteed, and may lose value.