Building a case for a rolling recession

Whether it’s a hard landing or a soft landing of the economy, a recession may be the most widely anticipated nonevent since Y2K. While both hard- and soft-landing camps are confident in their claims, perhaps the actual economic outcome lies somewhere in the middle...a "rolling recession". Rather than a simultaneous and comprehensive downturn, or the outright avoidance of a contraction, a rolling recession is a more staggered response to financial conditions affecting different areas of the economy at different times.

This week's highlight article from Goldman Sachs builds the case for a "rolling recession" and how this phenomenon may more accurately describe current economic conditions in the US.

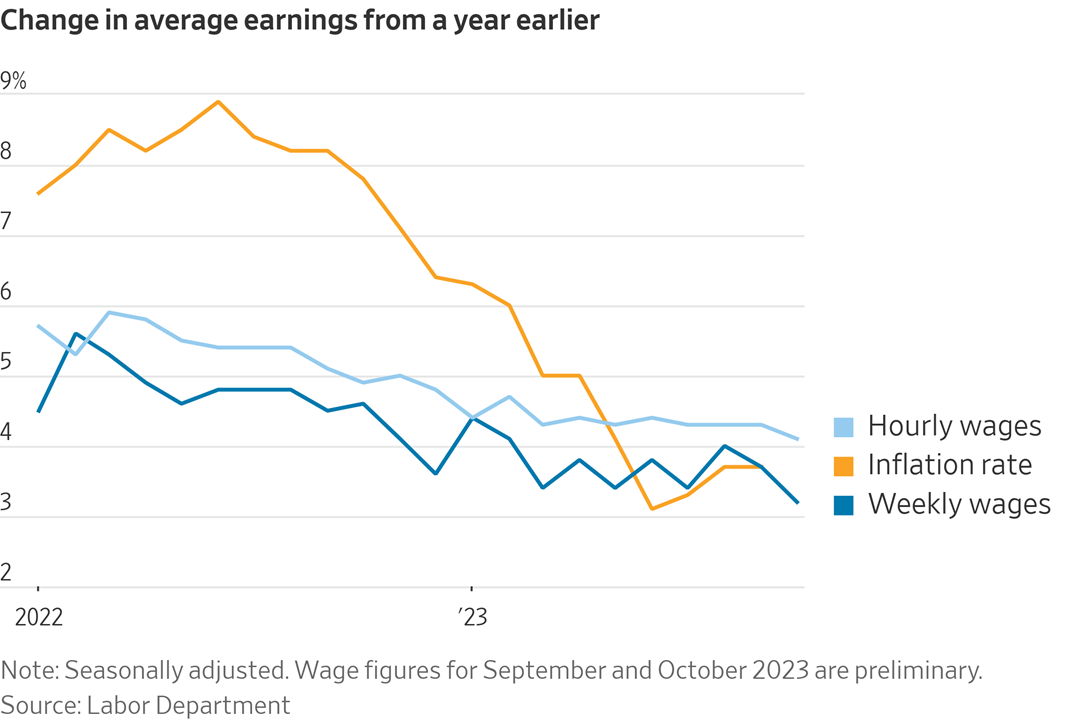

Wage growth cooled as employers hired less. Average hourly earnings rose 0.2% from a month earlier and 4.1% from a year earlier, down from 4.3% in September. In the last three months, they rose just 3.2% annualized. Cooler hiring and rising unemployment alongside a downward trend for wages could bring the Fed’s historic interest-rate increases to an end.

Links to What Else We're Reading

Legacy Trust Family Wealth Offices

4200 Marsh Landing Blvd, Suite 100

Jacksonville Beach, FL 32250

Office: (904) 280-9100

Fax: (904) 280-9109

Legacy Trust Family Wealth Offices of Jacksonville Beach, Florida, is a new type of financial services firm - an independent multi-family office - that brings all facets of your personal financial affairs under one roof, where they are coordinated for optimum efficiency and maximum performance.

Investment products are not FDIC insured, are not bank guaranteed, and may lose value.