Third Quarter in review

“More of the same” could casually describe the third quarter of 2022, as most key traditional asset classes and categories suffered through a third consecutive bumpy quarter, with performance losses blanketing the landscape. Central to the theme of elevated volatility and negative performance was stubbornly high inflation, both domestically and abroad, with policymakers in the United States and Europe taking further action to help bring aggregate demand and available supply more closely into balance.

This week's highlight article from our research consultant, FEG, offers a thorough review of the current market environment, addressing concerns and highlighting opportunities emerging once volatility subsides.

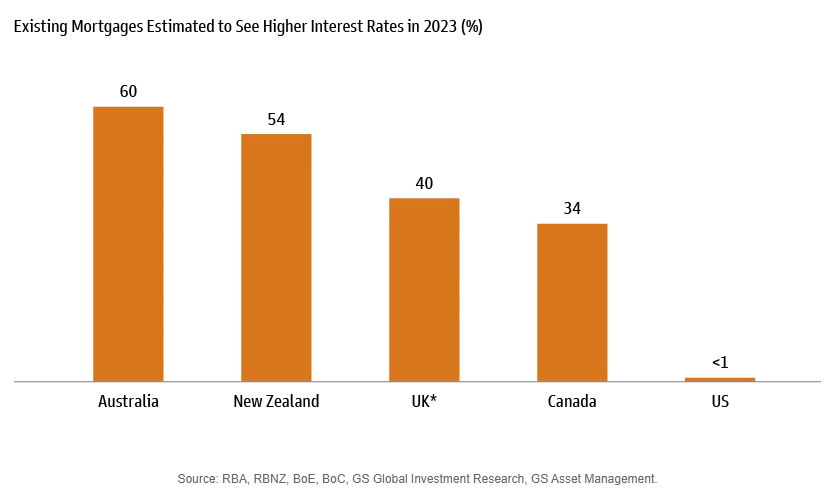

Variable rates abroad

Mortgage rates have risen sharply in response to aggressive interest rate hikes; however, the US appears to be better insulated from mortgage payment shocks in 2023, when compared to other countries, primarily because of the popularity of variable rate mortgages abroad. Goldman Sach's Global Investment Research team expects that less than 1% of US mortgages will face higher interest rate payments in 2023, while over half of mortgages in Australia and New Zealand will face higher rates.

What Else We're Reading

Legacy Trust Family Wealth Offices

4200 Marsh Landing Blvd, Suite 100

Jacksonville Beach, FL 32250

Office: (904) 280-9100

Fax: (904) 280-9109

Legacy Trust Family Wealth Offices of Jacksonville Beach, Florida, is a new type of financial services firm - an independent multi-family office - that brings all facets of your personal financial affairs under one roof, where they are coordinated for optimum efficiency and maximum performance.

Investment products are not FDIC insured, are not bank guaranteed, and may lose value.