Weekly Reading Recommendations

An Investing Plan for This Year (Dimensional)

How to See Through Wall Street's Ritual of Wrong (WSJ)

China's Advances Could Boost AI's Impact on Global GDP (Goldman Sachs)—————————————————————————————————————————

This Week's Highlight Article

How Should Investors Think About Tariffs in 2025?

News about new US tariffs on goods from Canada, Mexico, and China (and the announcement of retaliatory tariffs) prompted markets to sell off in an immediate response on Monday. Before the day came to a close, however, we learned that the tariffs on Canada and Mexico would be delayed by a month. While these events continue to unfold, it’s important to take a look back at the market response to the tariff wars in the first Trump administration. History doesn’t repeat itself but it can rhyme — and the first Trump administration trade wars are arguably the best guide we have.

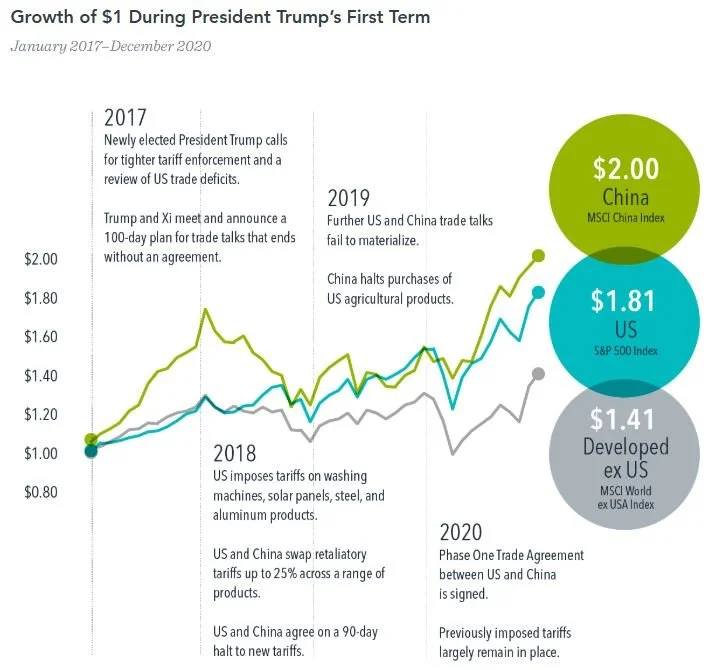

Beginning in 2017, the administration eyed China as a target and, by 2018, began imposing tariffs across a range of products. The next couple of years saw back and forth trade discussions that eventually led to an agreement, though pre-existing tariffs remained in place. As highlighted in the chart below, despite all this uncertainty, both China and the US posted higher cumulative returns than the MSCI World ex USA Index over the four years of Trump’s term.

Markets are forward-looking, and the economic impact from initiatives such as tariffs is likely already reflected in current market prices. When these expected developments come to pass, the effect on markets may be muted.

There is much more tariff talk than tariff action, which does not mean that markets don’t react negatively in the short-term, but does mean that investors need to separate the signal from the noise. In 2025, as tariffs fluctuate in the headlines, market opportunities may arise when tariff implementation and consequences are mispriced.

If we equal-weight indexes by giving each constituent company the same percentage regardless of size, it becomes obvious how much a few giant US companies are changing perceptions. What comes as a surprise to many is that on an equal-weighted basis, the total return on MSCI’s index for Europe has actually outperformed its US Index since the beginning of 2023.

Legacy Trust Family Wealth Offices

4200 Marsh Landing Blvd, Suite 100

Jacksonville Beach, FL 32250

Office: (904) 280-9100

Fax: (904) 280-9109

Legacy Trust Family Wealth Offices of Jacksonville Beach, Florida, is a new type of financial services firm - an independent multi-family office - that brings all facets of your personal financial affairs under one roof, where they are coordinated for optimum efficiency and maximum performance.

Investment products are not FDIC insured, are not bank guaranteed, and may lose value.