Weekly Reading Recommendations

The Price-Inflation Paradox: How Tariffs Really Affect The Economy (Forbes)

NEPC's Perspective on Tariffs & Market Swoon

Market Timing a Recession (A Wealth of Common Sense)—————————————————————————————————————————

This Week's Highlight Article

Stock Stumble in Perspective

The recent stock market pullback and ongoing volatility has naturally raised concerns amongst investors. Add in some of the fast moving news headlines over the last few weeks and we can certainly appreciate why some may feel anxious. However, it's crucial to maintain perspective throughout these inevitable bouts of weakness; corrections and volatility have always been the price that investors must pay in order to capture any long-term market returns.

While the market has, historically, spent most of its time in an updraft, it’s important for investors to remember that downdrafts are also a common and routine part of the ride. Depending on how one slices the numbers, the market has historically been in a downdraft about 30% to 40% of the time. While maintaining one's composure as an investor is difficult during that 30% to 40%, such composure is critical to investment success.

In this week's highlight article in link below, Fidelity looks to put the recent stock market volatility into perspective and highlights why the recent market pullback may feel worse than it is.

“It may also help to remember that markets can react to news headlines and emotions in the short term,” says Naveen Malwal, Institutional Portfolio Manager at Fidelity. “But over the long run, stocks have usually risen if corporate profits are growing. Corporate profits rose about 14% during the fourth quarter of last year and are expected to experience double-digit growth in 2025, based on analysts’ estimates.”

Click Here to Read: Stock Stumble in Perspective

Charts that Matter

Economies of Trade

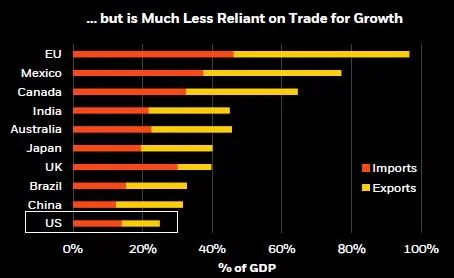

While tariffs do pose an uncertainty to growth, viewing them in isolation may miss the bigger picture. It is important to understand the nature of different global economies and their trade dependencies.

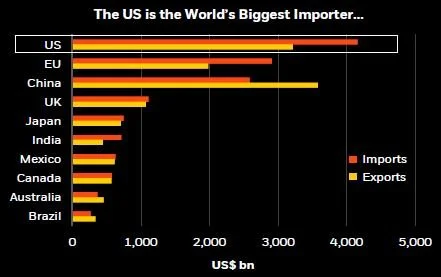

The U.S. is the largest importer in the world (1st chart below) (i.e. drives revenues for other countries),

BUT

the U.S. is also the most self-sufficient (2nd chart below), which can help can growth relatively well-insulated.

If we equal-weight indexes by giving each constituent company the same percentage regardless of size, it becomes obvious how much a few giant US companies are changing perceptions. What comes as a surprise to many is that on an equal-weighted basis, the total return on MSCI’s index for Europe has actually outperformed its US Index since the beginning of 2023.

Legacy Trust Family Wealth Offices

4200 Marsh Landing Blvd, Suite 100

Jacksonville Beach, FL 32250

Office: (904) 280-9100

Fax: (904) 280-9109

Legacy Trust Family Wealth Offices of Jacksonville Beach, Florida, is a new type of financial services firm - an independent multi-family office - that brings all facets of your personal financial affairs under one roof, where they are coordinated for optimum efficiency and maximum performance.

Investment products are not FDIC insured, are not bank guaranteed, and may lose value.