FEDERAL RESERVE RATE HIKES

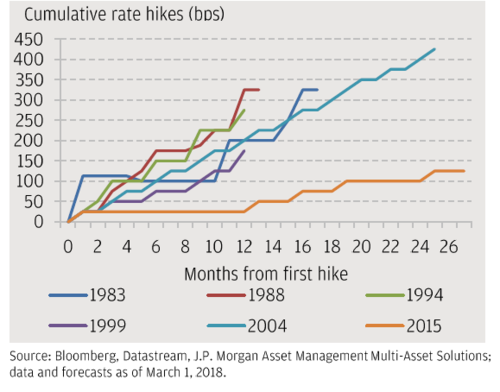

Rounding-out their 2018 Federal Open Market Committee (FOMC) meeting schedule, the Fed hiked the federal funds rate by 25 basis points (bps) at their mid-December meeting to an upper bound of 2.50%, the fourth hike of 2018 and the eighth hike in their current tightening campaign.

Global Asset Class Performances

2018 has proven to be a tough year for asset classes across the board. With 93% of global assets delivering a negative return year-to-date, 2018 is the worst year on record for this measure.

Stock Market Valuations

The S&P 500 Index’s Forward P/E ratio has hit multi-year lows as it remains in correction territory (down over 10% from record highs).

Companies Ramp Up Buybacks

Shares of several U.S. companies have rallied following recent announcements of increased share repurchases, a welcome development for investors bruised by recent market volatility.

Time in the Market more Important than Timing the Market

While some believe higher volatility brings better opportunities for market timing, such efforts face a high bar relative to just staying invested. Missing the best months in equities, which are often after drawdowns like those experienced in February and October of 2018, lowers holding period returns materially.

Valuation Across Asset Classes have Declined in 2018

Equity and credit valuations are below 1990s average levels again. Equity valuations have de-rated due to a combination of price declines and still positive earnings growth.

Equity vs. Bond Performance

For the first time since 2015, global equities have underperformed bonds in 2018 year-over-year.

Economic Growth Expectations

Economists expect third-quarter gross domestic product (GDP) to come in at a 3.4% annual growth rate this week. If met, this would add up to the best back-to-back quarters since 2014 following the second quarter’s +4% growth rate.

Job Openings Spike to Record

Through August, the number of job openings increased to the highest on record, at 7.136 million. There are approximately 1.2 million more job openings than unemployed persons, potentially indicative of a lack of skilled available labor capital and/or a skills mismatch inherent in the labor force

Earnings Season Could Help Provide Bottoming Process from Recent Selloff

The benchmark S&P 500 index has risen in seven of the past nine earnings seasons, climbing on average 1.7% during the four weeks after big banks kick off the reporting period, according to Dow Jones Market Data. Even more encouraging is that in three of those periods, the S&P 500 had fallen in the four weeks leading up to earnings season. In other words, it’s not unusual for the equity markets to go through a period of weakness before earnings season. With analysts projecting a 21% growth rate in earnings for the third quarter, we expect this trend to continue.

Real Growth Expectations, not Inflation Expectations, Pushing Nominal Yields Higher

Nominal yields jumped on Wednesday with the 10-year U.S. Treasury yield touching 3.23%, a significant 14bp move in a 24-hour period. After retreating slightly, at time of writing yields have moved higher again reaching 3.24%, their highest level since February 2011

U.S. Economy Begins to Disappoint Lofty Expectations

The U.S. economy is growing at the quickest pace in over four years and, therefore, keeps raising the bar for economist’s expectations. The Citigroup Economic Surprise Index, a measure of whether economic reports are meeting projections, has fallen to its lowest level in nearly a year in the U.S. The gauge has dropped into negative territory, indicating releases are broadly starting to come in below expectations. At the same time, we are seeing a rebound abroad where expectations have been depressed.

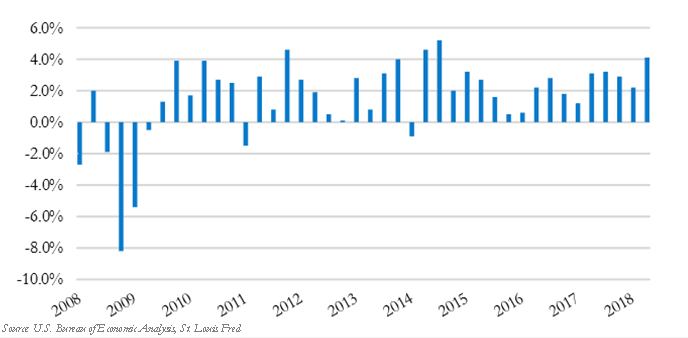

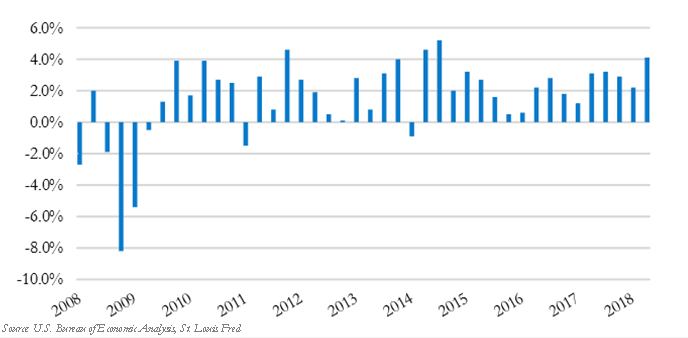

Economic Growth: U.S. GDP - Quarterly Growth Rate

The U.S. economy grew at the strongest pace in nearly four years during the second quarter. Gross domestic product (GDP) – the value of all goods and services produced across the economy – increased at a 4.1% annualized rate in the second quarter.

In Terms of Returns, however, the Current Bull Market Ranks only 8th

The pure duration of the bull run is impressive but not particularly surprising given the magnitude of the recession that the U.S. has rebounded from. From a return perspective, however, the bull market currently ranks in 8th place in terms of annualized returns.

The Current Bull Market has Become the Longest One on Record

The current bull market began on March 9th, 2009 when the S&P 500 was as 676 points. 9 ½ years and 323 percent later, the S&P 500 officially set the record for the longest bull market run on Wednesday. With double digit earnings growth paired with strong economic growth, there should be room for it to extend this record.

Emerging economies may remain susceptible to appreciating US Dollar (USD)

Trade war concerns, continued tightening of U.S. monetary policy, and more recently an appreciating USD, have weighed on emerging market assets in 2018. Continued USD strength may complicate government funding for those economies that rely heavily on external debt to finance their economy. Across the emerging markets, the IMF estimates that external debt total servicing costs are near 10% of GDP, which, is above long-term average levels, but below peak levels witnessed in 2015

Consumer Spending Remains Strong

With a strong second quarter growth rate, investors are now turning their attention to the third quarter. Retail sales, released last week, provide a good omen with a strong 0.5% monthly growth rate; suggesting consumers remain healthy which should provide continued support for economic growth

Conference Board LEI & Business Cycles

Conference Board Leading Economic Index (LEI) data for June was released last week and showed that the LEI increased 0.5% month-over-month. The index level increased to 109.8 in June, a new cycle high. As the name of the index suggests, this composite of indicators is designed to lead the business cycle, with recent solid growth supportive of near-term economic gains and implying a business cycle still exhibiting an expansionary bias.

Broad Strength

Broad strength across all sectors are expected for second quarter earnings season with Energy leading the way.

Escalating Earnings

Rallying oil prices, strong U.S. economic data and buoyant consumer confidence have pushed analysts’ earnings estimates higher since the start of the second quarter.

The U.S.-China tariff war and the S&P 500

Equity markets continue to be conflicted between the benefits of tax reform and the turbulence of tariffs.

Contribution to S&P 500's Gain

Just four stocks have fueled over 82% of the S&P 500’s 2.6% gain on a year-to-date basis through June 30th. Excluding these stocks, the S&P 500 would only be up 0.48%. Excluding the top seven stocks, the S&P 500 would be in negative territory for the year. During an average year, the 10 stocks with the greatest impact typically account for only 45% of the market’s price moves.

US Effective Tariff Rate

The proposed tariffs - if implemented in full - would increase the average effective US tariff rate by about 5 percentage points (pp) and take the US back to levels last seen in the 1970s.

Total US Imports Affected

Counting the tariffs. So far, duties on $55.7 billion of imports have been implemented, including tariffs on washing machines and solar panels, steel and aluminum. A first round of tariffs on $34 billion of imports from China is set to take place on July 6th unless an agreement is reached. From here, President Trump has threatened three further steps: a 25% tariff on an addition $100 billion from China, 20% on $275 billion of auto imports and 10% on an additional $300 billion from China.

June - 2018 Fed Hike Probability

The Federal Open Market Committee will be announcing their next policy decision tomorrow. Another rate hike is nearly fully priced into the markets with a probability of 84%.

Evaluation of Atlanta Fed GDPNow real GDP Estimate For 2018: Q2

The Atlanta Fed’s GDPNow model forecast for second quarter economic growth remains above 4.5%. Even if the model is overestimating growth by 1%, the second quarter is staging an impressive rebound.

Economic Policy Uncertainty Remains Elevated

Politics continue to cause uncertainty and angst for the markets as they dominate the headlines. Most recently, the announcement of new governments in Italy and Spain and the implementation of steel and aluminum tariffs on some of our largest trading partners, including Canada, Mexico and the European Union.

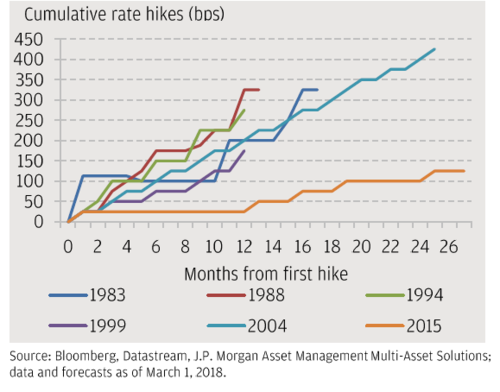

Cumulative Rate Hikes

While the Federal Reserve is increasing interest rates in the U.S., this rate hiking cycle is set to be the longest and shallowest on record.

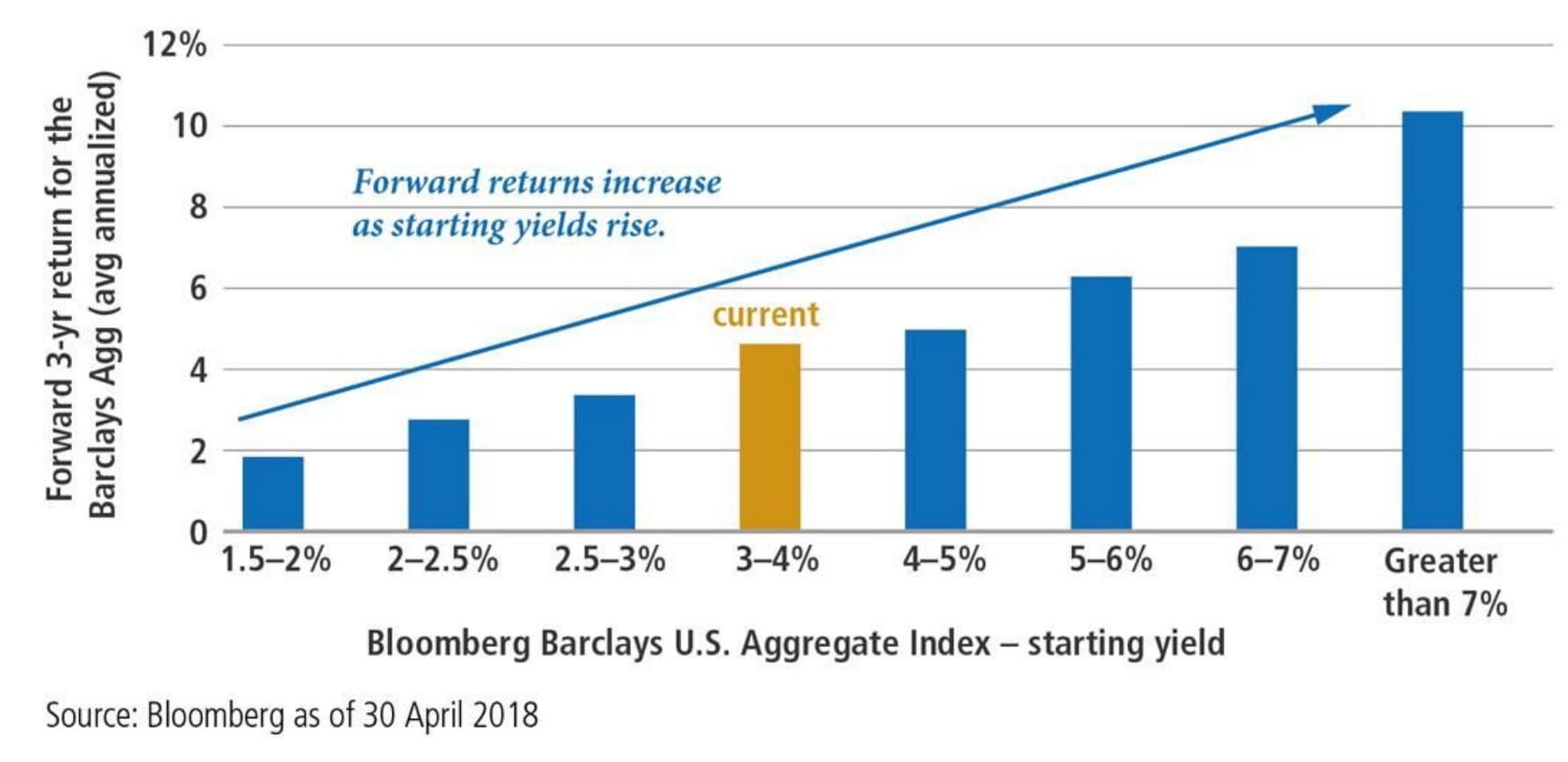

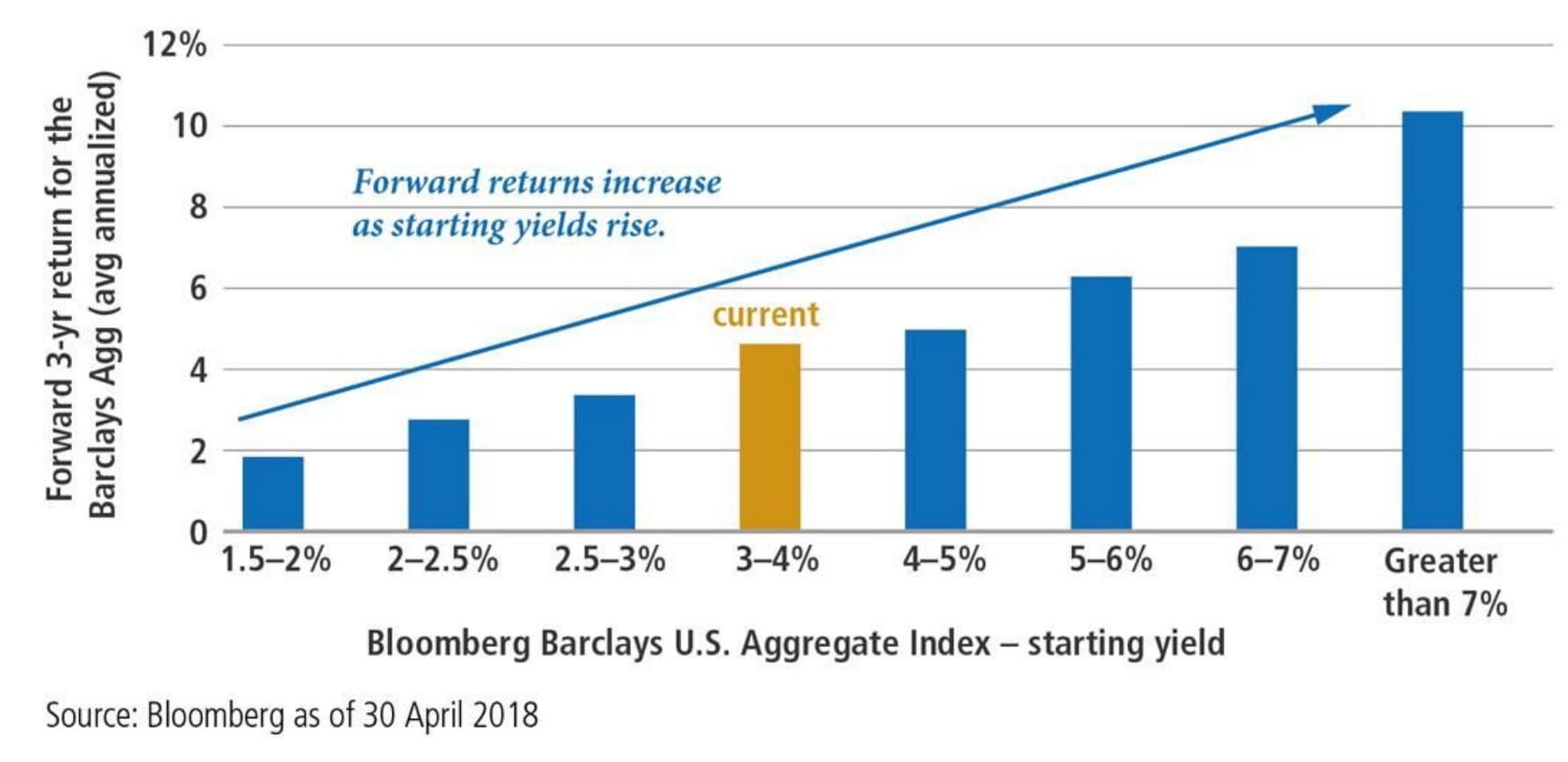

Forward Returns Increase

The 10-year U.S. Treasury Yield has firmly breached the headline-grabbing 3% threshold to 3.1% - the highest level since 2011. It is important to remember that rising rates – although painful over the short-term as bond prices move inversely to yields – are beneficial to fixed income investors over the long-term.

The Current U.S. economic expansion is now the second largest in post-war history (107 months)

This month, the current U.S. economic expansion reaches the 107-month mark, making it the second longest economic expansion on record. The next milestone is 13 months from now – June 2019 – at 120 months and it is looking increasingly likely that this expansion will continue for more than a year and set the new record.

2017-18 Trend In Global EPS Much Stronger Then In Prior Years

Earnings revisions have been on a strong upward trend since mid-2017. With first quarter earnings season wrapping up, companies have exceeded approximately 80% of analyst earnings estimates; therefore, providing an even higher growth rate than what was anticipated for earnings.

Coordinated Growth

Global growth has stepped up in a synchronized fashion. Nearly all countries tracked by the Organization for Economic Co-operation and Developed (OECD) are recording positive growth rates – the first time since the global financial crisis.

Volitatiy Reemerges In The Market

Equity market volatility as measured by the volatility index (VIX) remained tepid throughout 2017. The market’s reaction to inflationary fears, increasing interest rates and a potential trade war has led to volatility roaring back in 2018.

Comparing Size of Tariffs With Incremental Fiscal Policy

The markets are conflicted between the benefits of tax reform and the turbulence of tariffs. The size of fiscal stimulus, driven by tax reform, dwarf the size of tariffs announced thus far. Nevertheless, tariffs and the potential for trade war have been a destabilizing factor for the markets and will likely continue to be until we gain further clarity.

Headline GLI vs. Global Industrial Production

Goldman Sach’s proprietary indicator, called the Global Leading Indicator (GLI), meant to provide an early signal of the global industrial cycle is showing signs of weaker growth in global industrial production.

Advance Goods Monthly Trade Balance

The announced steel and aluminum tariffs have now gone into effect. Going forward, a 25% tariff will be placed on steel imports and a 10% tariff placed on steel imports. These tariffs are due in large part to the material trade deficit that the U.S. has – particularly with China. The monthly trade deficit for January widened to a 9 ½ year low likely adding more fuel to President Trump’s agenda of fair trade.

Profit Margins Have Been A Key Driver Or Earnings Growth

Expansion of profit margins have been a key driver of earnings growth in the U.S. since the global financial crisis. Should the Federal Reserve continue to raise rates and wage growth continue to grow, profit margins will likely come under pressure. Stronger revenue growth will need to offset this dynamic in order for earnings to continue to grow strongly.

Corporate Earnings Revision Ratios, 2008-2018

We have witnessed a sharp acceleration in U.S. earnings upgrades as analysts have factored in the impact from the tax cuts and fiscal stimulus. The ratio of analyst upgrades to downgrades for U.S. large caps has spiked to the highest level since the data series started in 1988.

S&P 500 Index

Pullback in perspective. The recent market correction has put the markets back on the trajectory of the last two years.

C.S. VelocityShares Inverse VIX Short-Term ETN

The dangers of “following the crowd” and chasing the latest trends are illustrated in the following chart. Strategies that provide inverse (e.g. “short”) equity volatility exposure gained significant attraction over the past two years as volatility remained abnormally subdued. As equity volatility spiked to a 2 1⁄2 year high recently, the popular Credit Suisse VelocityShares Inverse VIX Short-Term exchange traded note (ETN) – which had over $1 billion of assets - lost nearly all of its “value” and is now being liquidated by Credit Suisse.

Buyer Beware

Investors piled into equities during the month of January as the set the record for the biggest month of flows into equity funds on record, according to Bank of America Merrill Lynch. Interestingly, there was one group of investors that wasn’t so anxious to buy at these levels: company insiders who must report their purchases of stock in the companies they work for.

US Treasuries vs Bond Volatility

U.S. Treasury yields have been under pressure in 2018 while implied volatility is at record lows. This looks quite similar to that seen just prior to the “taper tantrum” in 2013 and could portend the beginning of the fourth bond market tantrum since 2014.

Up or Down 1% Days (2017 is YTD)

2017 was one of the calmest years on record with very steady returns. There were only eight days when the market moved by more than 1% during the calendar year. As the year moved, the calmness grew. None of the eight 1% moves occurred in the fourth quarter. While we believe 2018 will provide another strong set of returns for equity investors, they should be prepared for more heightened levels of volatility to accompany returns.