Technology: Transformative & Deflationary

Mobile phones have replaced many of our previous everyday items while also increasing individual operating efficiency of users tremendously with their multi-functional nature. This simple, yet informative, graphic also illustrates how technology is a deflationary force over the long term.

Volatility..All Part of Investing in the Stock Market

This week's chart provides a look at what investors must tolerate in order to receive the premium returns delivered by the stock market over the long term. While it is easy to get caught up in the day-to-day movements of the stock market, focusing on the long-term is paramount as the probability of achieving a positive return increases significantly.

Supply Chain Improvements

Supply Chain Improvements

The latest ISM Services Index update - utilized to assess the overall health of the broad based services industry in the United States - was released this week and was noteworthy on two fronts. 1) Prices paid fell quite a bit month-over-month, which sparked a brief rally in equities as this bodes well for the inflation outlook. 2) Delivery times have plummeted, as shown in the chart below, which is indicative of very loose supply chain conditions (relative to the backlogs experienced throughout COVID). With inflationary measures in the services sector being the most stubborn component, these metrics bode well for the outlook on inflation and the continuation of the downward trend that we've seen since July 2022.

A Check in on Valuations

The Magnificent Seven stocks, comprised of Microsoft, Apple, Amazon, Tesla, Nvidia, Meta and Alphabet, drove a majority of returns in the S&P 500 Index last year, raising concerns from some investors. However, these are also some of the most profitable and cash flow rich companies in the world. And while their valuations are elevated relative to the remaining stocks in the S&P 500, they're still well below prior peaks. In fact, as shown in the chart of the week below, they are currently trading near their average price-to-earnings ratio since 2015.

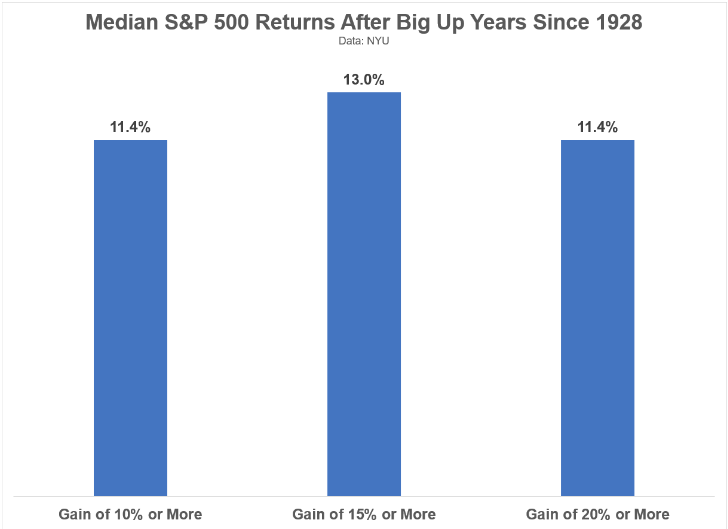

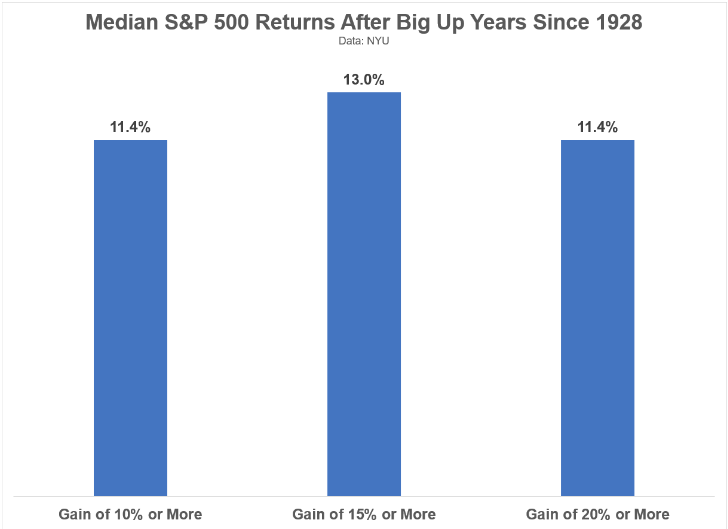

Median S&P 500 Returns After Big Up Years

The chart above shows the median returns for the S&P 500 in the ensuing year following gains of 10% or more, 15% or more and 20% or more.

Why It Matters: Many times good returns are followed by good returns but sometimes good returns are followed by losses. The lesson is an especially important one because is shows the futility of making investment decisions based on short-term data. Wise investors focus on the long run and avoid allowing the short run to dictate investment decisions.

A Lesson on Forecasting

Lesson 1: No One Is Very Good at Consistently Getting Market Forecasts Right

The only value in market strategist forecasts is that they show that a wide dispersion of outcomes is possible. The S&P 500 ended 2022 at 3,839.50. The forecasts of 23 analysts from leading investment firms for year-end 2023 ranged from as low as 3,650 (down 5%) to as high as 4,750 (up 24%). The average forecast was for the S&P 500 to end the year at 4,080 (up 6%). It closed the year up 26.4%.

The chart above from Avantis shows that not only is such a wide dispersion of potential outcomes likely, but the median forecast is typically wrong by a wide margin.

The lesson is that investors are best served by following Warren Buffett’s advice on guru forecasts: “We have long felt that the only value of stock forecasters is to make fortunetellers look good. Even now, Charlie [Munger] and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.”

Why It Matters: The lesson is an especially important one because investors, like all humans, are subject to confirmation bias. Thus, when we hear a forecast that confirms our own beliefs or concerns, we are more likely to act on it than if we hear a contrary opinion.

October Inflation Data Shows Progress

The Consumer Price Index (CPI) was unchanged in October, below the consensus expected +0.1%. The CPI is up 3.2% from a year ago - a huge improvement versus the 7.7% reading in the year ending October 2022. The actions taken by the Federal Reserve to fight inflation continue to gain traction.

Geopolitical Events & Market Movements

How have markets historically reacted to geopolitical crisis events, including wars and terrorist attacks? We look back at two dozen or so such events going back to World War II in the table below:

While the total drawdown related to this tragic event and recovery timetable are unknown, based on prior geopolitical events, the average drawdown is -4.7%, while the average time to reach market bottom is 19 days, and the average time to fully recover losses is 42 days. In other words, equities have historically held up well during geopolitical shocks, including wars and other military conflicts going back decades, with the average recovery taking roughly two months. Even the market recovery from 9/11 took only 31 days.

An Update on Housing

What homebuyers need to know: It’s more expensive than ever to buy a home. The median monthly mortgage payment hit an all-time high of $2,632 during the four weeks ending September 10. Although the weekly average mortgage rate has declined slightly from August’s two-decade high, it’s still sitting above 7%. Prices are up, too, increasing 4% year over year.

What home sellers need to know: Prices continue to rise because inventory is so low, posting one of its biggest declines in 19 months this week. But keep in mind that high prices, elevated rates and the lack of inventory is sending some buyers to the sidelines; mortgage-purchase applications are hovering near a three-decade low and pending home sales are down 12% year over year.

The Search for Savings

While higher rates are a negative for borrowers, investors and savers have been raving this year about how much they can now earn on their cash. However, investors who deviated from a diversified portfolio have been left scratching their heads as the stock market continues to climb the wall of worry - the S&P is up 18.5% YTD and a diversified 60/40 portfolio is up double digits as well.

Home Prices Lead Rents

Owner's equivalent rent - the official measure of housing price inflation for CPI - is not a real time data point. As shown in the chart below from PGM Global, home prices typically lead the owner's equivalent rent CPI measurement by 18-24 months.

Why It Matters: With this measure just now starting to move lower, this should help inflation continue to tick lower in the coming months.

Resisting Temptation

Abandoning strategic equity allocations may be most tempting at the end of central bank tightening cycles when cash yields reach their most attractive levels. Historically however, exiting the equity market to invest in cash at these inflection points has not provided durable capital appreciation in the longer term. Investors may need to exercise discipline in maintaining target equity weights to achieve long-term return targets.

Golden Handcuffs

US housing shortages may provide a cushion to home price declines in 2023. Refinancing activity will likely remain weak given many homeowners’ “golden handcuffs,” which describe existing attractive mortgage rates disincentivizing borrowers from moving homes. For example, less than 2% of conventional borrowers pay more than the current market rate on a 30-year fixed rate mortgage, potentially limiting motivation to refinance even if rates fall.

International Markets at Steep Discount

Based on forward Price/Earnings Ratios, International equity markets are trading at one of the largest valuation discounts relative to the US equity markets on record following their decade+ stretch of underperformance. This is paired with a nearly decade long rise in the value of the US dollar relative to foreign currencies. Cheap equity markets paired with cheap currencies bode well for forward looking returns.

Savings Remains Elevated

The "excess savings" economists often refer to was driven by a combination of a significant drop in spending and increase in fiscal support during the pandemic. A degree of this "excess savings" has been spent down over the past 1.5 years but continues to be elevated.

Commercial Real Estate Debt

Commercial real estate debt as a share of GDP is much smaller than residential mortgage debt thus reducing fears of another financial crisis akin to 2008.

Housing Affordability

Rental costs still remain below the cost of home ownership, even amid recent improvements in housing affordability. Elevated interest rates and still-lofty home values make ownership pricey. Meanwhile, rent prices on new leases have begun to roll over and will likely become a key driver for lower overall core inflation by year end.

Help Wanted

Recent labor market strength has surprised to the upside for 12 consecutive months, revealing a resilient, though gradually softening jobs market. Labor market demand will need to continue normalizing relative to supply to slow wage growth and ultimately bring down core inflation.

Headline CPI Surprises

March data shows easing energy prices helped pull U.S. headline inflation under 6% for the first time in over a year. However, "stickier" areas of CPI, like service, remain stubbornly elevated.

Terminal Decline

Over the past 18 months, the Fed has focused predominantly on one problem: inflation. However, recent financial system stress, may have altered policy priorities - or at least the market's perception of them. Over the past few weeks the market implied terminal rate has fallen as investors grapple with how much higher the Fed can hike without any further stress.

Money Supply Growth Drops to Slowest Pace in 60 Years

The year-over-year growth rate in Money Supply has decelerated to the slowest pace in at least 60 years as the Federal Reserve tightens monetary policy. As illustrated in the chart, rapidly declining money supply growth may help drive inflation lower.

Indicator Shows Progress on Labor Tightness

Fourth quarter earnings season is beginning to conclude and many companies are seeing a critical tailwind of inflation showing signs of weakness. The share of management teams citing labor shortages, now at less than a third of the peak in 3Q 2021, indicates loosening in the jobs market, which the Federal Reserve has indicated will be necessary to slow wage growth and broader inflation.

Contributors of Recent Disinflation

After a string of monthly declines, the January CPI report showed a bounce in headline inflation of 0.5% month over month (m/m) and 0.4% m/m excluding food and energy. Markets had largely expected the uptick, but the underlying components showed a more mixed inflation picture compared to the broad-based declines seen in prior months. Still, disinflation is likely in its early innings across the major components of CPI, as shown below, and should gradually bring inflation back down to 2-3% over the course of 2023 and 2024.

Manager Survey

Four Hundred portfolio managers attending Goldman Sachs' 2023 Global Strategy Conference were surveyed on their opinion of the best performing asset class in the year ahead. Relative to 2022, PM confidence in fixed income has risen the most, particularly for corporate bonds as higher yields, more attractive coupons, and an expectation for less interest rate volatility may continue to support portfolio asset rotations back into bonds in 2023. Predictions such as these should always be taken with a grain of salt, however the survey does provide meaningful insight into current sentiment and positioning.

Equities More Reasonably Valued in 2023

Last year at this time, equity markets were near record highs after the economy and corporate earnings surged in 2021 and interest rates remained low. As it became clear that the Federal Reserve would need to aggressively hike interest rates to control inflation, investors reduced exposure to risk assets — sending equity valuations lower. Higher interest rates can put downward pressure on price-to-earnings (P/E) ratios, and we saw this play out in 2022. While earnings grew throughout the year, valuations declined — with the S&P 500 Index forward P/E falling from 21.7x to now 16.8x, close to the 15-year average (black diamond).

Inflation Continues to Ease

Inflation eased in December for the sixth straight month. The consumer-price index (CPI), a measurement of what consumers pay for goods and services, rose 6.5% last month from a year earlier, down from 7.1% in November and well below a 9.1% peak in June.

Goods prices, a key driver of inflation over the past year and a half, fell for the third straight month in December as improving supply chains and reduced demand have relieved price pressures on goods.

Hikes in Review

With inflation reaching levels not seen in 40 years, the Federal Reserve (Fed) took aim at a soft landing and believed there was a plausible path to avoid a recession. With that goal in mind, the Fed instituted a series of interest rate hikes that were the most aggressive in decades.

Housing in Review

September numbers for home prices across the country were released by S&P CoreLogic Case Shiller earlier this month and provide the latest look at home prices across the country. Since the pandemic lows (Feb. 2020), the National index is up 41% through September 2022, while markets in Tampa, Phoenix, and Miami are all up 63% or more. So far at least, areas in the southeastern US and south Florida that saw some of the biggest post-COVID gains have only seen minimal declines.

60/40 Performance Following Down Years

Performance for an illustrative traditional 60/40 portfolio has been challenged in 2022 amid surges in interest rates, recession risk, and broader market uncertainty. However, as shown below past instances of 60/40 drawdowns have delivered strong performance in subsequent calendar years.

Yields Reverse

The yield on 10-year Treasury Bonds are on pace for their largest monthly decrease since 2020 (as yields decrease, prices increase) as the Fed hints at potentially slowing down the pace of interest rate hikes. It is important to remember, however, that the Fed is set to continue hiking rates. The true question is where the terminal rate ends.

Variable Rates Abroad

Mortgage rates have risen sharply in response to aggressive interest rate hikes; however, the US appears to be better insulated from mortgage payment shocks in 2023, when compared to other countries, primarily because of the popularity of variable rate mortgages abroad. Goldman Sach's Global Investment Research team expects that less than 1% of US mortgages will face higher interest rate payments in 2023, while over half of mortgages in Australia and New Zealand will face higher rates.

Good Service?

Services have replaced durable goods as the main driver of US core inflation today, contributing nearly 70% to the overall print. While elevated, we see a potential path for core inflation to moderate in 2023 as easing supply bottlenecks drive down prices on durable goods. However, some of those deflationary impulses will likely be offset by sticky wage acceleration.

Dark Before Dawn

Equity market volatility has historically clustered, leading the best periods in the year to often directly follow the worst periods. Weak equity market performance may continue to reflect fundamental concerns over inflation, monetary policy, currency movements, and a bevy of other factors. Still, being invested at the best days often requires withstanding the worst days, informing our preference to stay the course.

Timber!

Lumber prices have fallen to their lowest level in more than two years, bringing two-by-fours back to what they cost before the pandemic building boom and pointing to a continued slowdown in construction.

Markets & Midterms

With less than two months before election day in the U.S., midterm elections are top of mind for politicians and voters alike. And while control of the U.S. Congress and influence over future policies may be at stake, should investors care? Not much, as our Chart of the Week below shows. Markets are less concerned with election results and much more concerned with simply getting past the election. Since 1962, the S&P 500 has returned just .3% on average for the 12 months leading up to midterms, and a staggering 16.3% average return in the months following once elections conclude.

Don't Fret the Debt

Consumer debt has grown rapidly year-to-date, with revolving credit balances increasing at a 17% annualized pace. However, such debt has yet to pose a significant strain on households. With servicing costs low and household excess savings at $2.2 trillion, outstanding debt has remained at manageable levels. As a result, the delinquency rates for various loan types remain extremely low, meaning strong household balance sheets can likely sustain the current debt balances.

Outstanding Mortgage Rates

Despite current 30 year mortgage rates well into 5% territory, the vast majority of homeowners have a mortgage rate below 4% with 1/3 of borrowers capturing a rate below 3%. This data has significant implications on future homebuying as many current owners may be reluctant to move and lose such an attractive rate, opting to "trade-up-in-place" and remodel their existing home instead.

Gassed Out?

Perhaps the first glimpse of relief at the pump, we've seen gas prices trending down since mid-June. While gas prices are indeed down, they're still up much more than usual year-to-date. From a seasonal perspective, this is normally a time of year when gas prices are trending lower, so this year's drop is not out of the norm. In the chart below, the red line shows this year's change in gas prices, while the blue line shows the average pattern that gas prices have taken throughout the year going back to 2005.

Bear Markets = Big Opportunities

Bear markets are central to the volatile path that markets follow, and we should recall that over the long term, that path is up. The good years will ultimately outweigh the bad year. History has made clear that bear markets are opportunities for long-term investors.

S&P 500 Performance

Following back-to-back weekly declines of over 5%, the S&P 500 gives investors some respite, closing out a strong week to finish the quarter. The chart below highlights just how rare of a phenomena this is - with just 8 occurrences since 1970.

S&P 500 Intra-Year Declines vs. Calendar Year Returns

This chart shows the maximum intra-year equity market drawdowns since 1980. Despite average intra-year declines of 14.3%, the S&P 500 has managed to deliver positive returns in 31 of the last 41 calendar years. Despite multiple wars, recessions, pandemics, and crises, the S&P 500 has never failed to regain a prior peak— and then surpass it.

A Bad Start in Historical Context

2022's market performance is being added to the history books. 100 trading days into the year, and the S&P 500 Index has notched its worst start to a year since 1970. Not all is lost, however, as history has demonstrated a bad start doesn't always equate to a bad year. Taking a look at the previous five worst starts to a year saw the remainder of the year higher every time, up 19.1% on average. While the path to get there may not be pretty, the markets have always persevered over the long-term.

Distribution of US Stock Market Returns

Annual stock market returns are unpredictable, but “up” years

have occurred much more frequently than “down” years in

the US. That may be reassuring to investors, especially if they

find market downturns unsettling.

• The US stock market posted positive returns in 75% of the

calendar years from 1926 through 2021.

US GDP Growth Remains Strong

S&P 500 Returns Following Yield Curve Inversion

The US Treasury curve saw a brief inversion of the 2 year & 10 year treasury yeilds as rates markets priced in accelerated Fed tightening. While an inverted yield curve has historically been a signal for recession, we believe the curve may be more prone to inversions today given low absolute yields, quantitative easing, and elevated inflation. The historical time lag between an inverted curve and a recession has ranged from 7-35 months. In that time, the S&P 500 continued to deliver positive returns on median.

Market Impact of Rate Hikes

Last week, the Federal Reserve raised rates for the first time since 2018. Despite concerns that Fed rate hikes are bad for equities, history has proven otherwise. While Fed rate hikes have led to higher volatility, looking at the previous eight hiking cycles the S&P 500 was higher a year after the initial rate hike every time.

The Consumer & Gas Prices

The consumer is poised to weather the current oil price shock. Household balance sheets and income statements are historically strong. While the price of gasoline breaches new highs, spending on gasoline and other energy goods as a percent of disposable income for the consumer remains below average at 2.3%. While this is set to increase in the coming months, it still has a significant way to go before breaching the highs reached in the prior decade.

Strength of Labor Market

U.S. hiring boomed in February as the economy added 678,000 jobs - exceeding economist forecasts for 423,000 jobs - and the unemployment rate fell to 3.8%. Importantly, the labor force participation rate increased to 62.3% - a welcomed increase as the supply of workers remains constrained. Nevertheless, the labor market still has 1.729 million jobs to add to stage a full recovery from the pandemic-induced recession.

Trends in Strength

The S&P 500 is up 86% of the time in the year following an annual performance of 25% or more. A hawkish Fed and continued COVID related volatility are valid concerns, but being bearish simply because of stellar performance in 2021 historically has been a unfavorable stance.

Value Returns in 2022, So Far

The bars in the chart above show the average year-to-date performance of the stocks in each decile of the Russell 1,000 Index. The stocks with the lowest price to sales ratios are on the left side of the chart, while the stocks with the highest price to sales ratios are on the right side of the chart. As shown, the decile of stocks with the highest price to sales ratios are already down an average of 7.8% so far in 2022. As you move from left to right on the chart, YTD performance gets worse and worse, meaning the higher the price to sales ratio, the worse performance has been. So far in 2022 we've seen a clear trend emerge: investors are selling stocks with high valuations and buying stocks with low valuations.