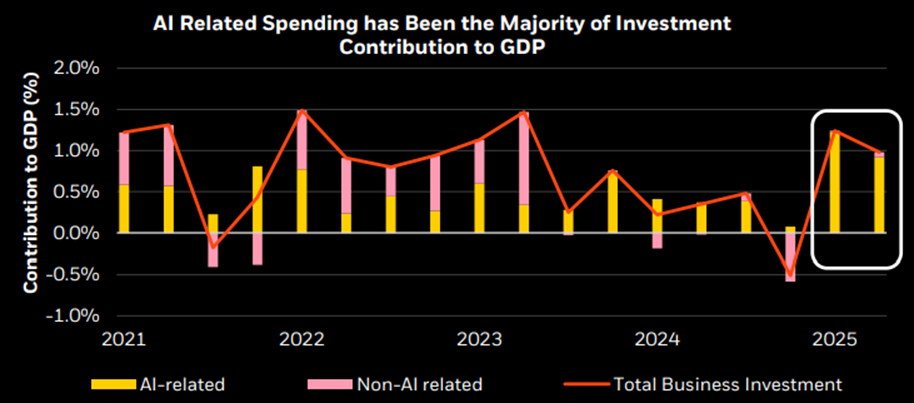

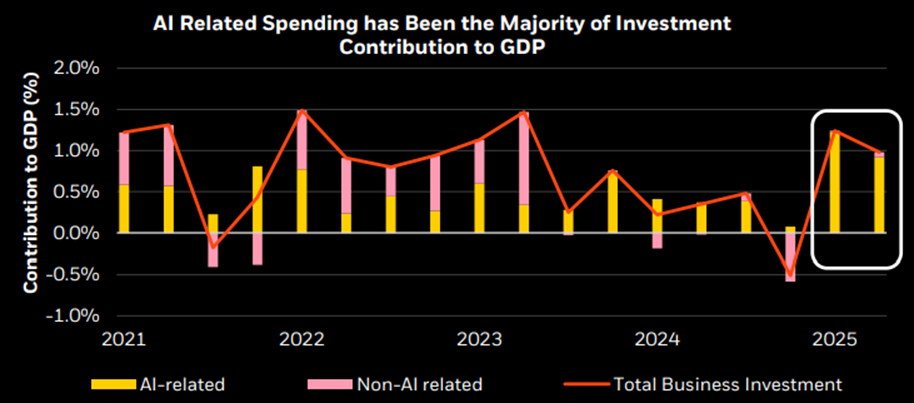

AI Capex Has Been Historic

The Capex driven by the “AI Race” has clearly been historic. In fact, AI related spending has contributed to nearly 33% of economic growth (GDP) in 2025.

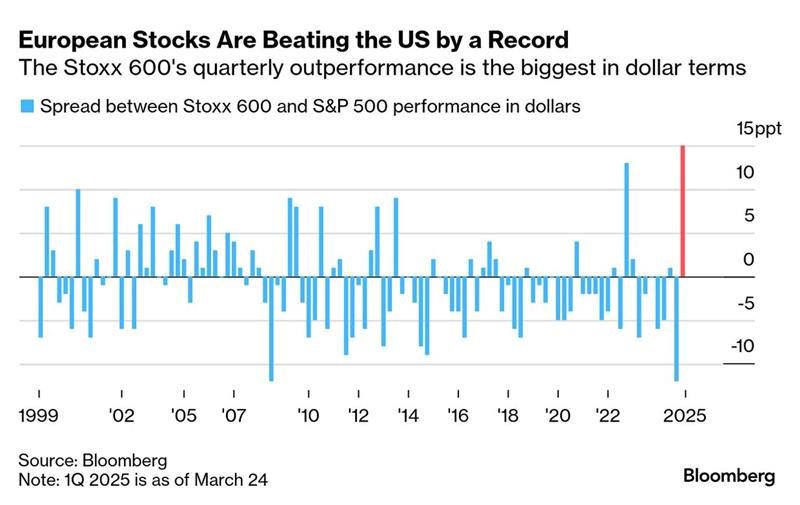

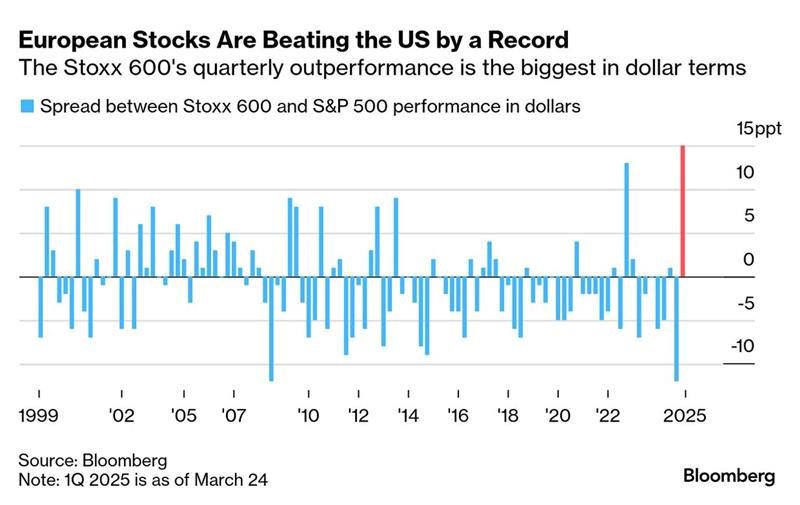

Tides Potentially Turning

International markets have surged this year, with European stocks leading the way, defying predictions that Trump's trade war would further harm the European economy and its stock market. Instead, his on again off again tariff announcements have created uncertainty in the US, prompting investors to look at valuation opportunities across the Atlantic. Additionally, Germany's new spending plans and their positive impact on growth and earnings potential have further sparked the rally.

Technology: Transformative & Deflationary

Mobile phones have replaced many of our previous everyday items while also increasing individual operating efficiency of users tremendously with their multi-functional nature. This simple, yet informative, graphic also illustrates how technology is a deflationary force over the long term.

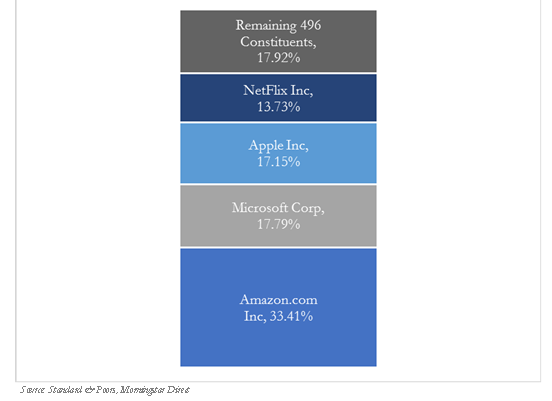

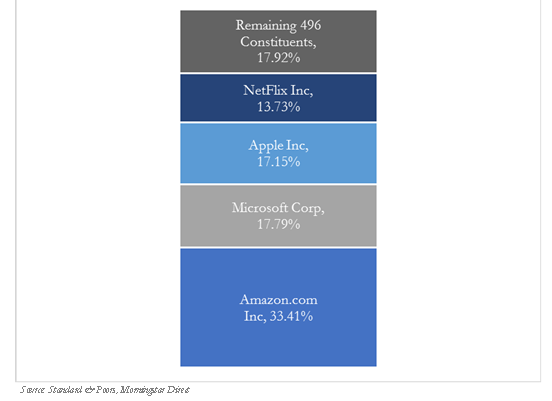

S&P 500 Weighting of Top 5 Stocks

The winners of today doesn’t mean they will be the winners of tomorrow. Maintaining market leadership can be challenging. The 5 largest stocks in the S&P 500 back in 2000 represent just 8% of the S&P 500 today.

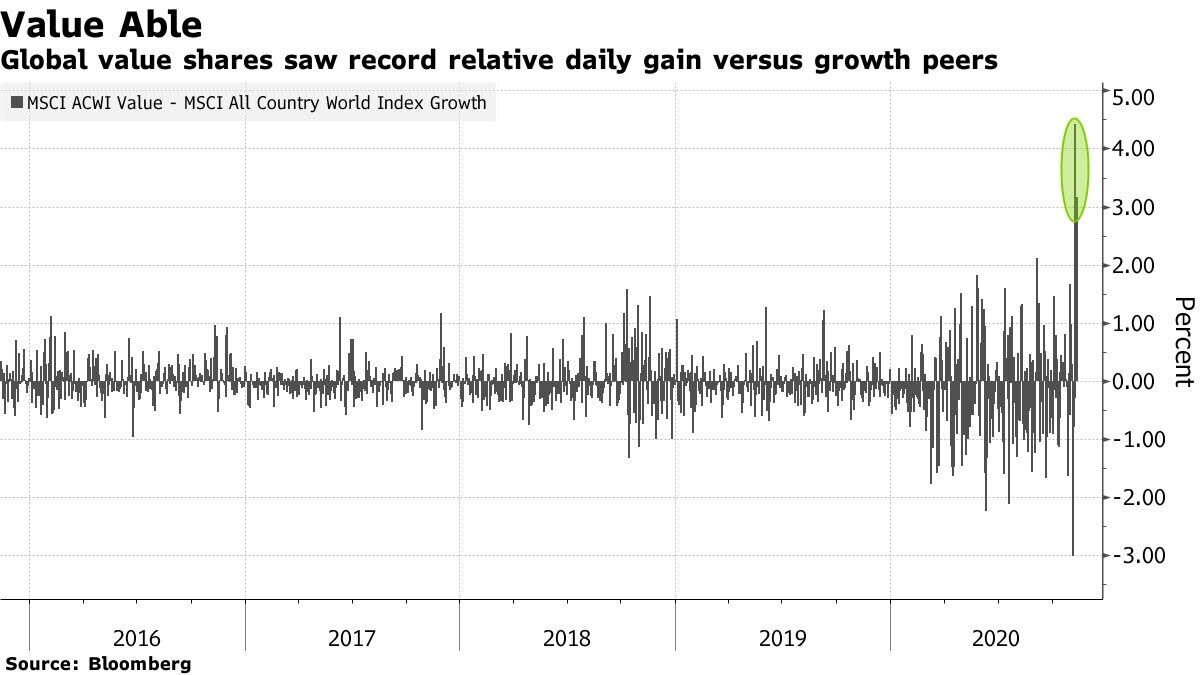

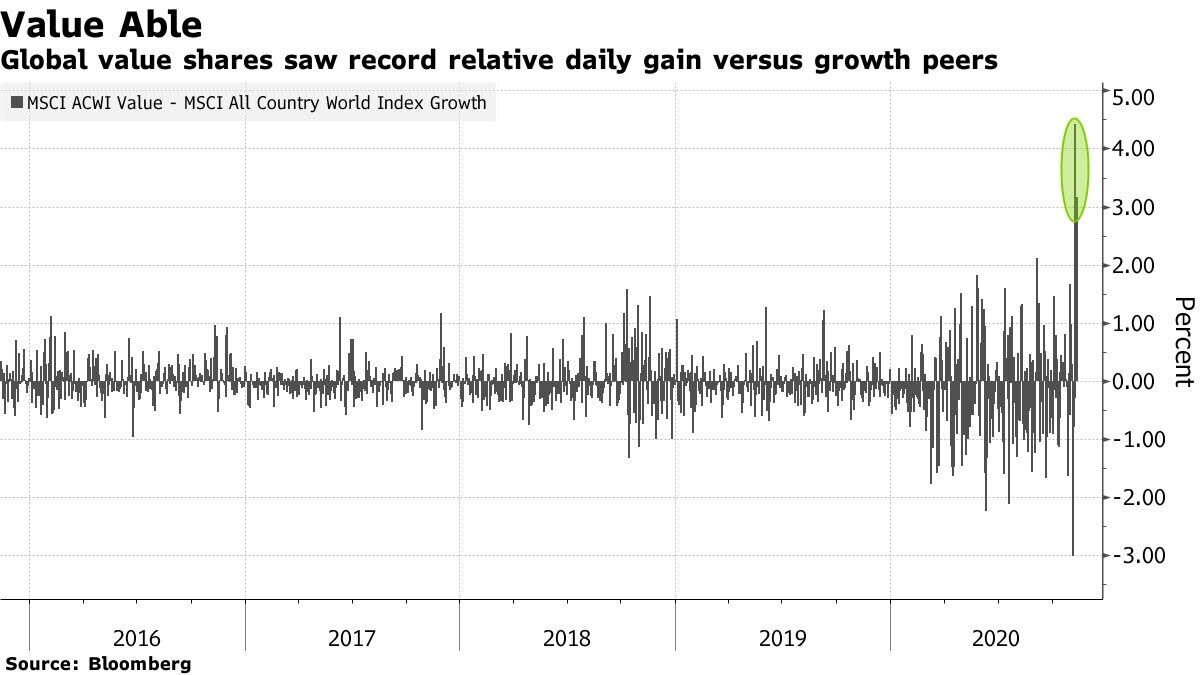

The Violent Rotation From Growth To Value

The recent positive vaccine news from Pfizer serves as a boost to value stocks that have been beaten-down throughout the pandemic.

U.S. Job Openings

The number of U.S. job openings climbs back to pre-pandemic levels as the labor market continues to recover.

Recovery in U.S. Real GDP

With historic third-quarter growth, the United States has now recovered two-thirds of the economic output lost due to the pandemic during the first half of the year.

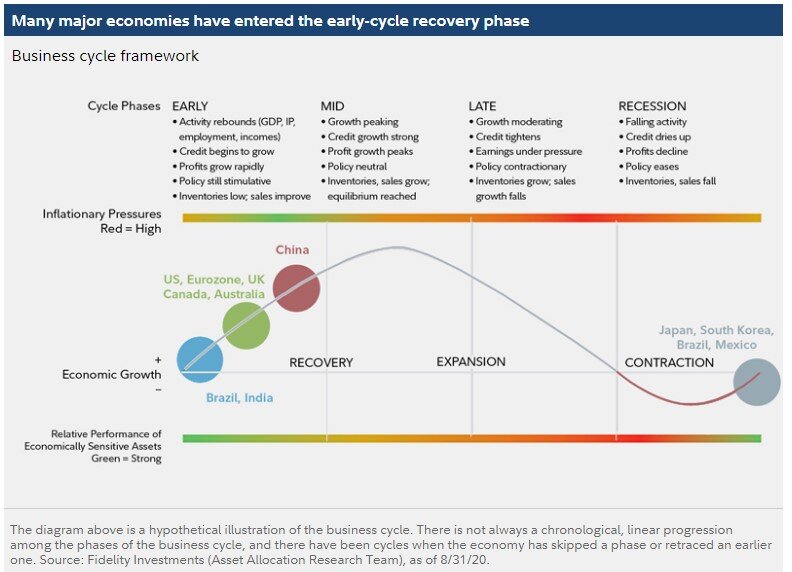

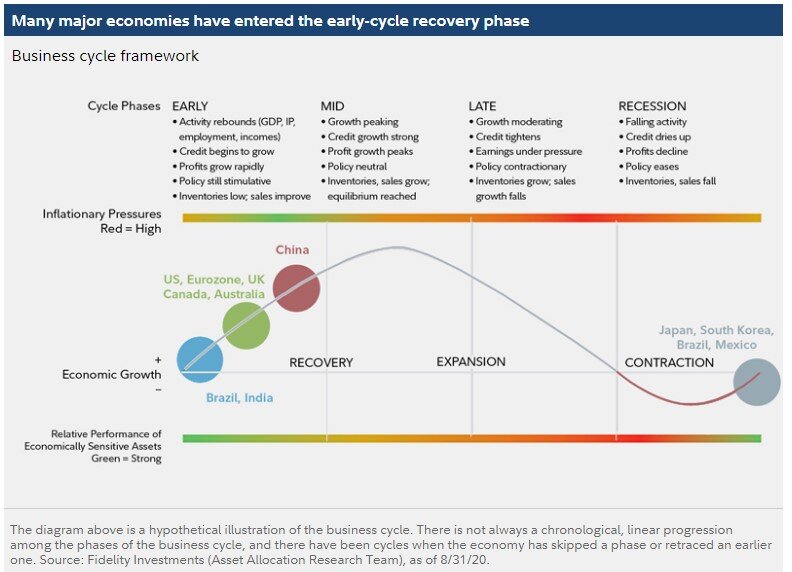

Business Cycle Update

Fidelity Investment’s Asset Allocation Research team, along with several other firms, believes the U.S. as well as many other major economies have progressed out of the recession and entered the early-cycle recovery phase of the business cycle. This bodes well for investors as equity markets have generated some of the strongest returns in the early cycle phase. Nevertheless, bouts of volatility should be expected as we approach the election and navigate the remaining uncertainties with the virus. Portfolio diversification remains critical to success when faced with uncertainty.

The Fastest Bear Market Recoveries

The U.S. equity markets took only 126 trading days to fully recover from the first quarter bear market (defined as a 20% or more decline in prices) – the fastest recovery on record. This also follows the fastest bear market on record as the S&P 500 lost 20% in just 16 trading days during the first quarter. Historically, the faster the decline the faster the rebound and this year is no exception

Staying Invested Matters

Time in the market is far more important than timing the market. By missing some of the market’s best days, investors can lose out on critical opportunities to grow their portfolio and market timing can have devastating results. By missing out on just the 10 best days in the market from 2000 to 2019 – a period that includes two recessions - an investor’s return would have been reduced by more than half. Even more notable is that six of the 10 best days occurred within two weeks of the worst 10 days for the markets! It’s always darkest just before dawn.

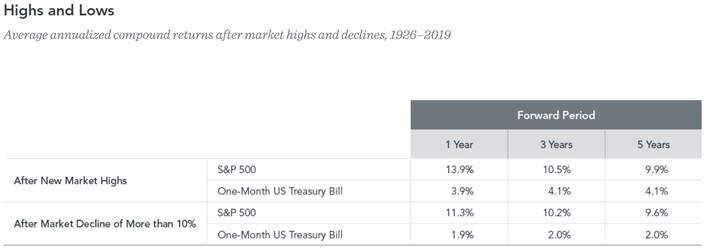

Waiting to Buy?

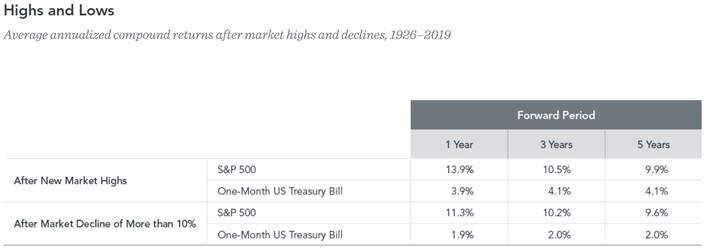

It may never “feel good” to invest new dollars into the equity markets. If markets are hitting new record highs, it may feel better to wait for a pullback before getting into the markets. Conversely, if markets have just fallen into correction territory (a drop of 10% or more), it may feel better to wait and see if the markets continue dropping in an attempt to catch the bottom. History reveals otherwise:

• After the S&P 500 index has hit all-time highs, the subsequent one-, three-, and five-year returns are positive, on average.

• After the S&P 500 has fallen more than 10%, the subsequent one-, three-, and five-year returns are also positive, on average.

It is important not to “anchor” your investment decisions based on price levels; recent market performance should not influence the timing of investing.

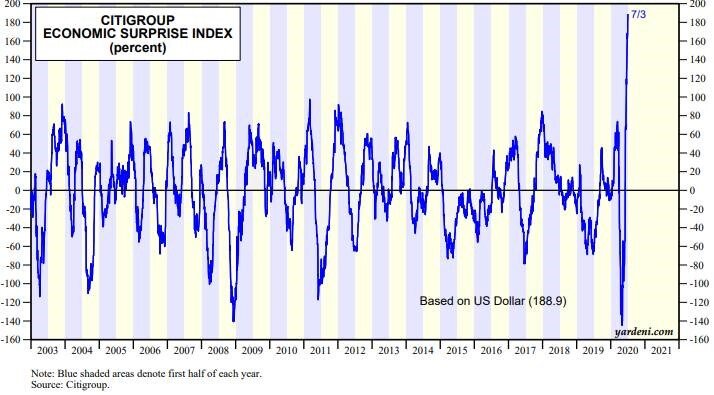

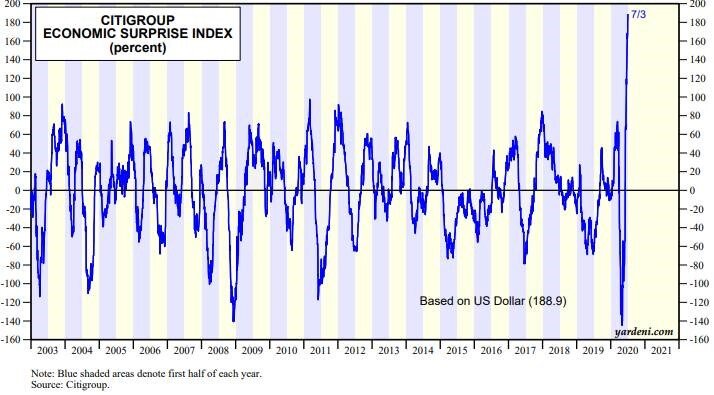

Economic Data Continues to Exceed Expectations

The equity market rebound since March has been supported by U.S. economic data that not only continues to improve in aggregate, but has also exceeded sell-side estimates for nearly the duration of 2020 as illustrated in the Bloomberg U.S. Economic Surprise Index – a measure of economic data reported vs. economists’ expectations.

Tech Dominance in S&P 500 Earnings

Some concern has been noted regarding the dominance of Tech in the S&P 500 – in terms of performance and also in weighting as the top 5 names account for 21.1% of the S&P 500 market cap. Looking at the earnings power of these 5 companies, however, reveals a picture that justifies high weighting as they account for approximately 16% of the S&P 500 index by earnings. Strong profits generated by selling products consumers want more now than ever, strong balance sheets, loads of cash, stable cash flows, little debt and solid management teams helps justify their strong performance as well.

Resilience in Emerging Markets

Emerging Market Growth forecasts have proven much more resilient relative to their developed market peers. Not only are their economies expected to post stronger growth rates, Emerging Market government debt as a % of GDP is half that of developed economies. Prospects for emerging markets look bright on a forward looking basis.

Continuing Jobless Claims in Decline

Continuing claims, which measure those individuals collecting unemployment benefits for at least 2 consecutive weeks, continue to gradually improve. For the week ended July 10th, continuing claims were slightly higher than 16 million, but down 9 million since May, indicating the labor market continues to move in a positive direction, albeit slowly.

US Industrial Output Roars Back

The streak of upside economic surprises continues. The June industrial production figures topped economists' forecasts, as factory output climbed further.

Europe Keeps Unemployment Rate in Check

Europe has been able to cushion the blow to the labor market through generous furlough programs where governments have provided subsidies to workers for the hours they’re not employed. This allows companies to keep more employees on their payroll without triggering a spike in unemployment. This also allows companies to avoid the costly process of rehiring workers as their economies restart. This is likely a factor in the outperformance of International Developed equity markets relative to the U.S. equity markets over the trailing 2-month period. It will be important to monitor the impact when Europe begins to slowly remove this life support for companies.

Economic Data Exceeding Expectations

The Citigroup Economic Surprise Index continues to reach record high levels as economic data has continued to exceed expectations. The index is a measure of economic data reported versus expectations. Measures above 0 indicate economic data has been exceeding analyst expectations. Hitting new records is supportive of the stock market as economic data continues to trend in the right direction (less bad) and exceed all expectations.

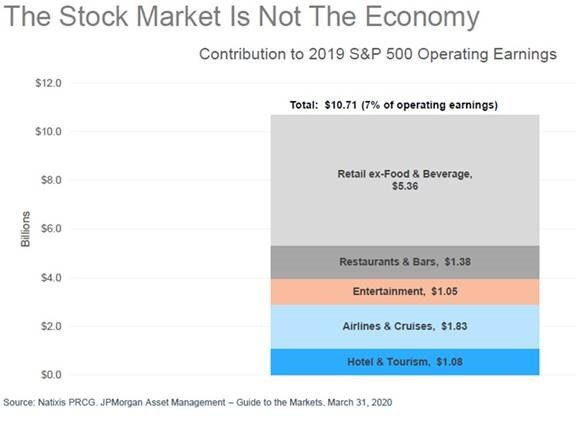

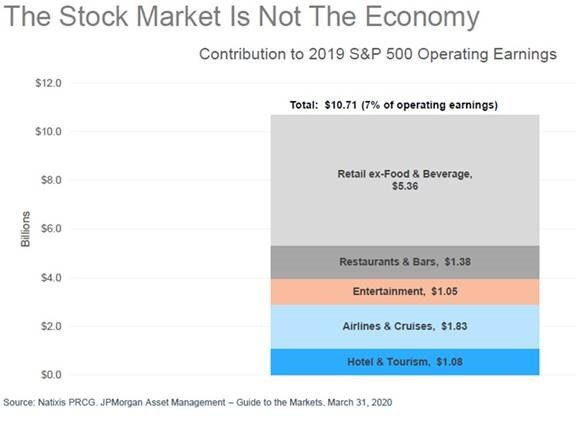

Stock Market Industries Impacted the Most

The following 5 COVID-19 sensitive industries accounted for less than 10% of S&P 500 operating earnings in 2019. Therefore, the direct impact to the stock market is not as significant as some may think.

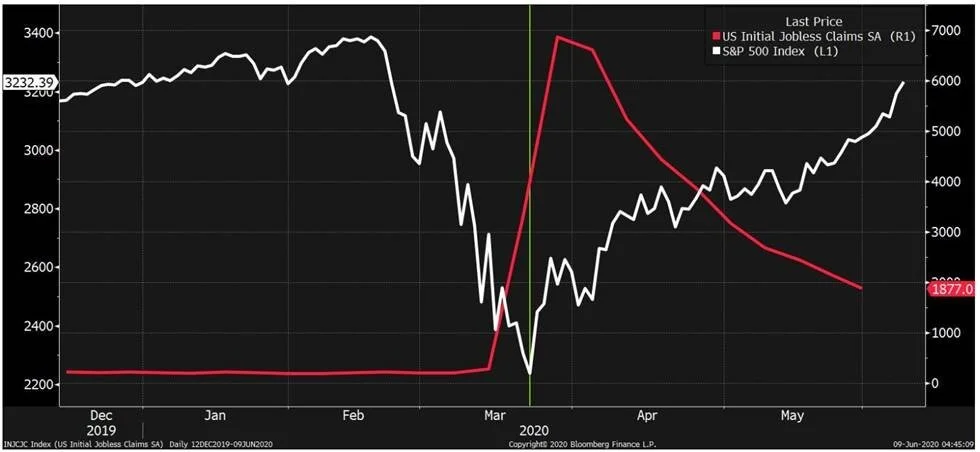

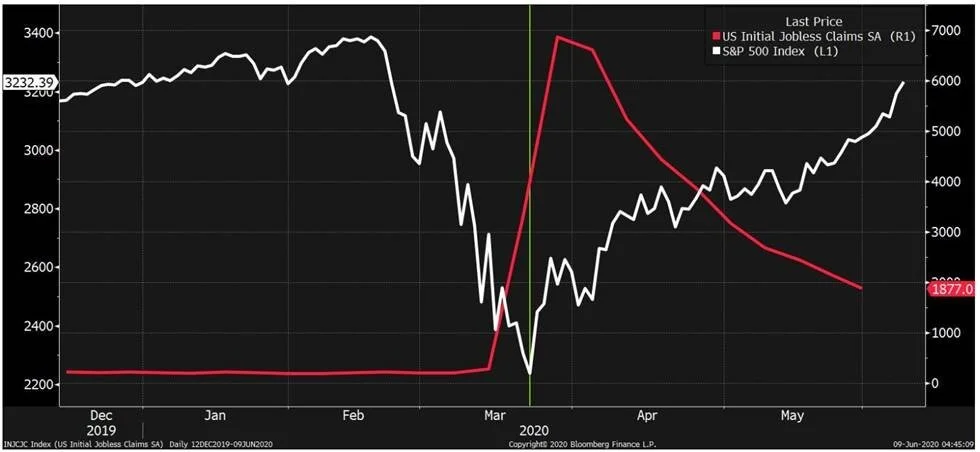

Stock Market vs. Economy

The stock market doesn’t need conditions to go from bad to great. Rather, it just needs to see an improvement in conditions. As the economy begins to heal, stocks have rebounded. You can see this clearly looking at a chart of the S&P 500 (white line) vs. initial jobless claims (red line). The stock market bottomed right as the pace of layoffs hit their most intense level, and has been rebounding alongside an ongoing decline in weekly job losses. While jobless claims are only one economic indicator, it does indicate conditions have started to improve.

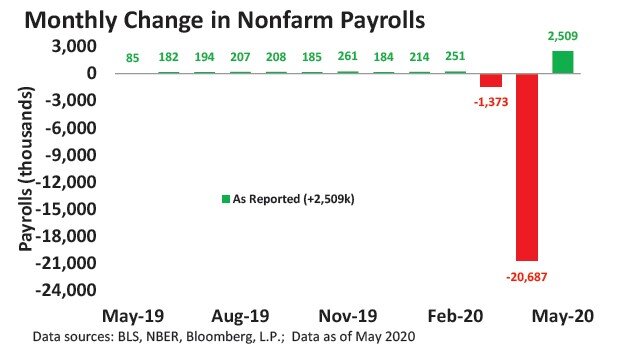

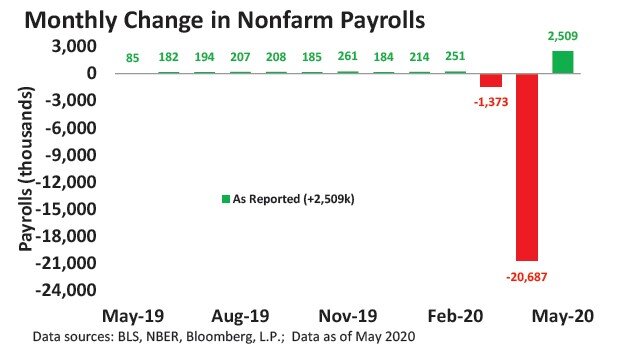

Labor Market’s Surprise Strength

Despite more than 9 million new claims for unemployment insurance in May, the U.S. economy added more than 2.5 million jobs in May versus the expected decline of 7.5 million. The 2.509 million jobs print was the strongest monthly gain on record and followed April’s decline of 20.687 million, which was the worst print in the history of the data, which dates to 1939.

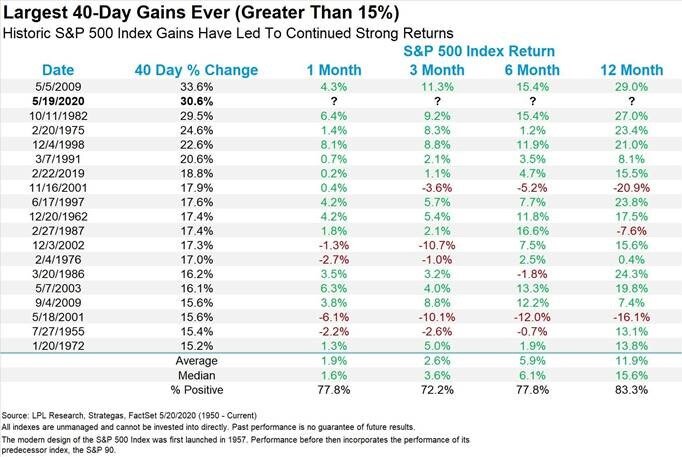

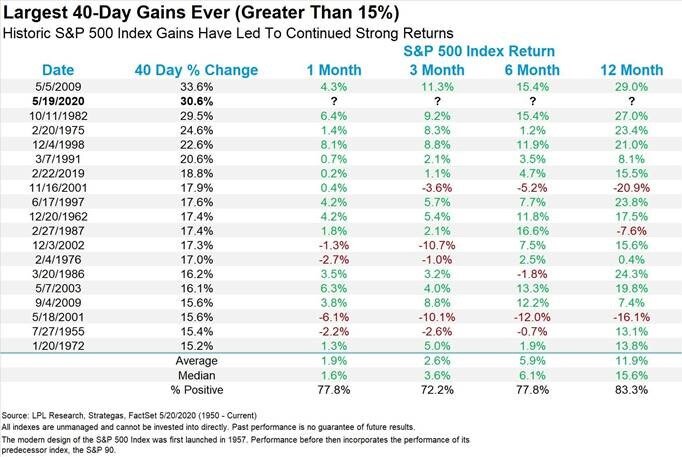

Equity Market Rebound

Through May 20th, the S&P 500 posted the second strongest 40-day rally on record, just behind the return posted off the March 2009 lows coming out of the Great Financial Crisis.

US Savings Rate

The US savings rate increased by the highest percentage in 39 years. U.S. incomes fell in March but not as much as spending did – leading to a substantial increase in savings rates. The question is whether or not households will boost consumption when lockdown eases – or be driven by fear and continue to save after realizing they were not equipped to get through this situation.

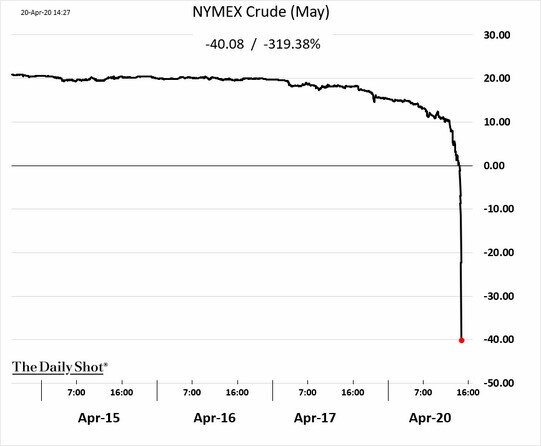

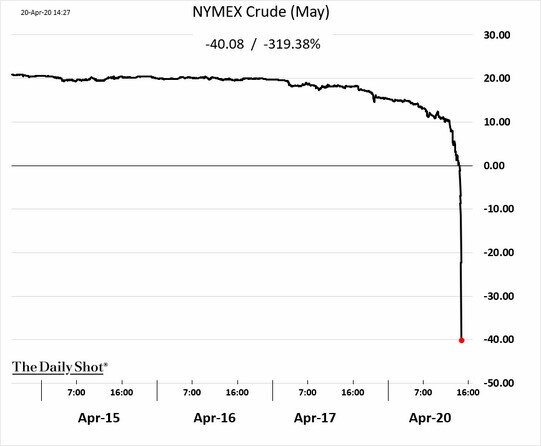

Energy Markets – A Perfect Storm

A glut of supply, demand coming to a hault and storage levels near capacity have driven oil prices to record lows. However, the selloff that reverberated across headlines yesterday was driven more by dislocation in the futures market. The May Futures contract for NYMEX Crude oil, set to expire today, fell deeply into negative territory as nobody wanted to take delivery on the expiring contract. Futures contracts for June held above $20/bbl.

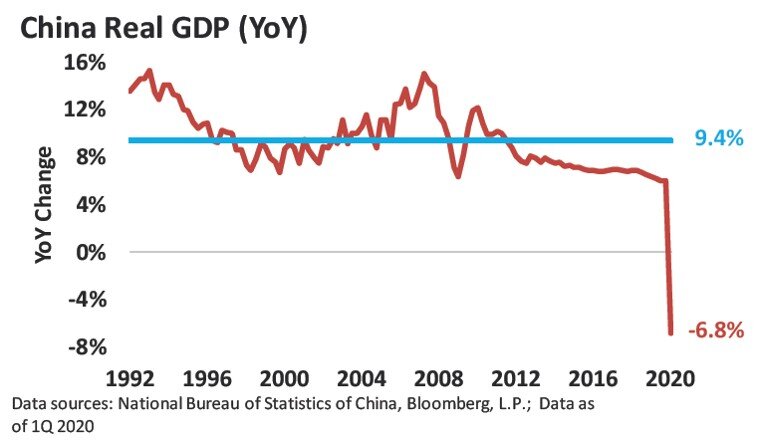

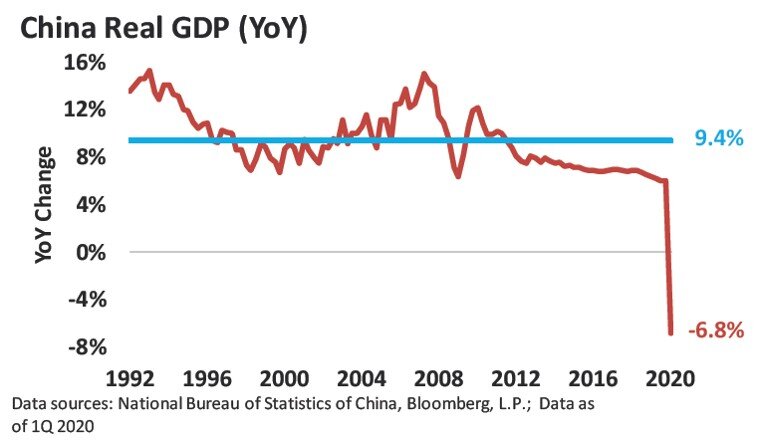

Chinese Economic Growth Crashes

The Chinese economy shrank 9.8% in the first quarter, the worst quarterly reading on record and dragging year-over-year (YoY) growth down to -6.8%, also a record low

Economic Uncertainty

The full roster of second quarter 2020 GDP (gross domestic product) estimates is a brief example of the economic uncertainty posed by the coronavirus. Regardless of which firm is right, the number is going to be ugly. To put in context, the peak-to-trough decline in GDP during the Financial Crisis was -4%.

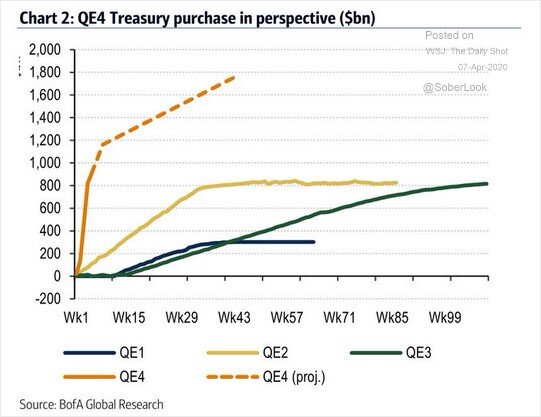

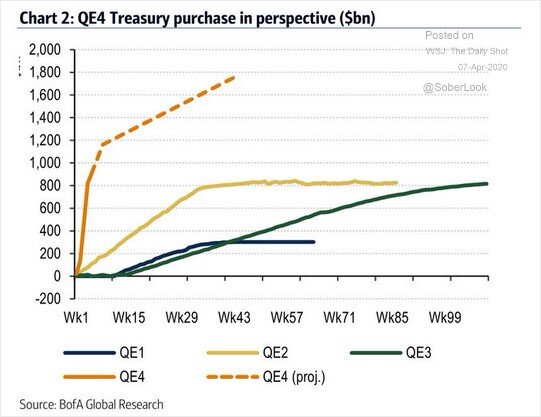

Quantitative Easing at Full Speed

The unprecedented speed at which the Fed has purchases securities and injected liquidity into the markets speak to the severity of the situation the economy is facing. The chart below compares the current quantitative easing (QE) program to the QE programs launched during and subsequent to the Great Financial Crisis.

Jobless Claims Surge

Number of Americans applying for unemployment benefits surged for a second week to reach nearly 10 million over the last two weeks. A record 6.65 million people filed claims nearly doubling the record set the week prior.

Oil Price Collapse

Price of oil collapses by almost 1/3rd to $30 per barrel as Saudi Arabia launches a price war in response to Russia refusing to cut production.

Flight to Quality

Amid fears of the coronavirus, U.S. Treasuries have benefited from a flight to quality. The 10-year treasury yield has fallen to a new record low (bond prices move inversely with interest rates).

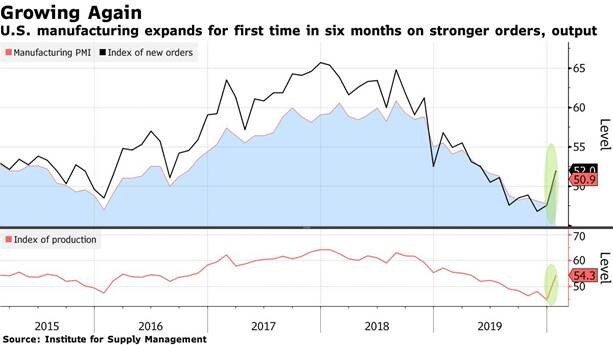

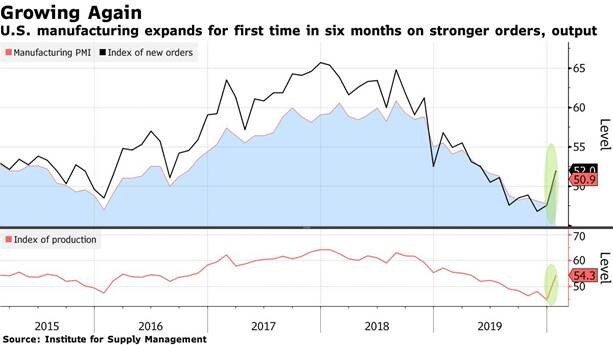

Manufacturing Activity Rebounds

The manufacturing sector continues to show signs of stabilizing following months of slowing down. While manufacturing only represents approximately 12% of economic growth in the U.S., the health of the sector is an important gauge for the overall economy.

Eurozone’s Economy Surprising to Upside

Citi’s Economic Surprise Index for the Eurozone – a measure of where economic data comes in relative to economist expectations – has rebounded sharply over the past few months as reported economic data continues to exceed depressed expectations.

Negative-Yielding Debt Jumps

Following several consecutive months of yields rising on the back of improving economic data, global interest rates have started to retreat as investors pile into safe-haven assets amid fears over the deadly coronavirus spreading from China. According to Bloomberg, the pool of negative yielding debt surged by $1.16 trillion last week – the largest weekly increase since at least 2016 when Bloomberg began tracking the data.

S&P 500 Leaders

The largest tech firms in the S&P 500 accounted for a sizeable portion of the market’s 2019 returns; with Apple contributing over 7% by itself.

Investor Fund Flows

Fund flows can serve as an indicator of investor sentiment. Despite the strong returns in 2019, investors pulled nearly $300 billion from the equity markets in 2019 in favor of money market funds (cash) and fixed income. A sign that this continues to be the most unloved bull market in history.

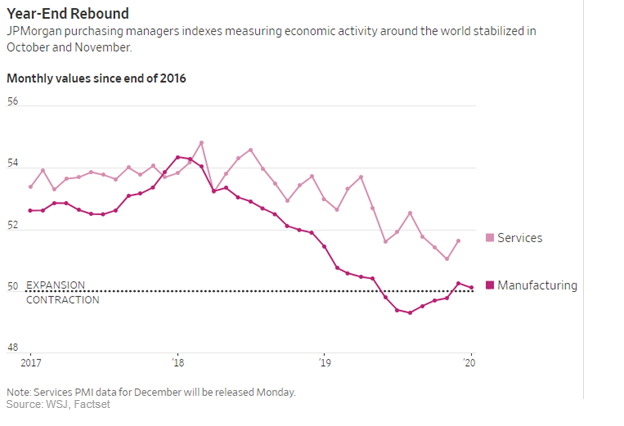

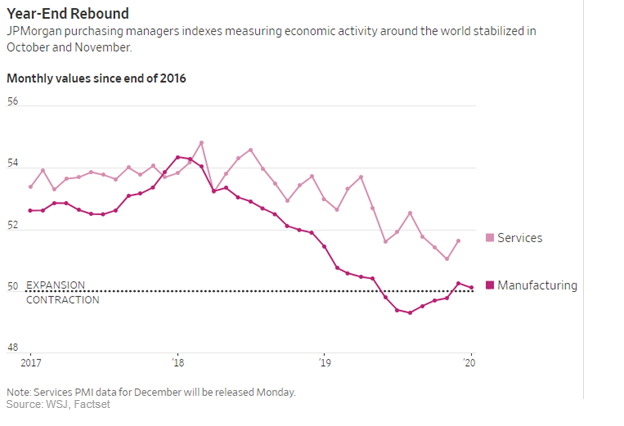

Global Growth Rebound

The JP Morgan Purchasing Managers Indexes (PMIs) – a measure of economic trends in the manufacturing and services sectors – stabilized heading into year-end. With the reprieve in trade tensions following the phase one trade deal, economic growth appears poised to accelerate through the first half of 2020.

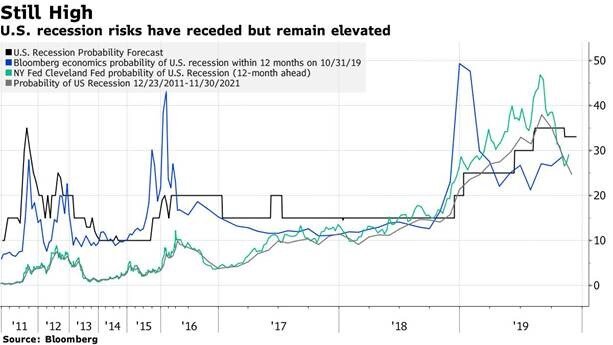

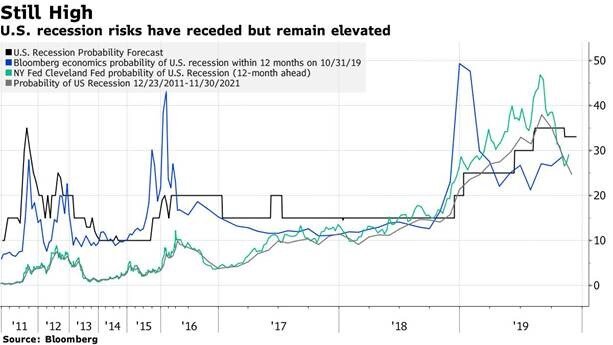

Recession Risks

Multiple economic models showed recessionary risks increasing throughout 2019 but have recently started to retreat. It appears that they will continue to come down from the elevated levels as the global economy is poised to continue to grow into 2020. Low inflation, easy monetary policy, robust consumer spending and a relatively strong global services sector combine to propel economic growth forward into the New Year.

Individual Investors Flee From Stock Market

The markets continue to climb the proverbial “wall of worry” as illustrated through investment flows amongst asset classes. Individual investors have pulled a record amount out of the equity markets this year despite the S&P 500 Index on pace for the best year since 2013. The equity markets have experienced seven consecutive quarters of net outflows; with these outflows accelerating significantly in the fourth quarter of 2018 (in the midst of the drawdown experienced - the timing could not have been worse; meaning most retail investors sold at the worst time and have not benefitted from the rebound we have experienced this year). This continues to be one of the most unloved bull markets in history.

"Winners" in Trade War

Countries that have benefited the most from the US-China trade dispute:

Value Versus Growth

Value stocks have staged quite the comeback over the past three months as the S&P 500 Value Index has delivered a return twice that of the S&P 500 Growth Index. Even after this brief stretch of outperformance, valuations for value stocks remain at their most attractive level in years relative to growth stocks.

Small Business Optimism

Small business optimism increased more than expected in October, rising from 101.8 up to 102.4 compared to economist expectations for an increase to just 102.0. After a sharp drop from its high in August 2018, small business sentiment hasn’t rebounded much off its lows, but it is at least showing some sign of optimism.

Yield Curve Normalizes

Earlier this year, longer-term yields fell below shorter-term yields leading to what is known as an inverted yield curve. In late August, the 3-Month Treasury Bill yielded 0.5% more than the 10-Year Treasury Note. We have since seen a normalization of the yield curve as it completely uninverted last week for the first time since November 2018 - a positive sign for investors.

International Equity Markets

The valuation levels of European stocks are significantly cheaper than that of U.S. stocks; a reflection of the market pricing in the ongoing political risks (e.g. Brexit) and growth concerns. Reversion to the mean is a powerful force. Should we begin to see a turnaround in macro data out of Europe, this reversion may begin to take hold with the market favoring International equity markets over U.S.

Total Return (WSJ)

Some investors associate safety with a stock that pays a hefty dividend yield. While the income potential might be attractive, it is always important to look at investments from a total return perspective which includes both price return and income return. As shown in this chart, stocks within the S&P 500 Index that pay the highest dividend are among the biggest decliners in terms of price over the past year. One can always “create their own dividend” by trimming the price appreciation of a stock that might not pay as much income.

Third Quarter 2019 Wraps Up (WSJ)

While the third quarter ended on a relatively quiet note, with the S&P 500 Index eking out a modest gain of 1.2%, it was a dizzying three months underneath the surface across the equity and fixed income markets. The chart illustrates the one of the key roles of fixed income in a portfolio – providing ballast in times of equity market stress – as yields fell sharply in August (yields fall, bond prices rise) in conjunction with the drawdown experienced in the equity markets.

Change in the Trend

The growth trade that has worked so well for investors this year – and over the course of this bull market run – has come under pressure over the past few weeks with value staging an impressive 4.1% outperformance streak since August 27th.

Global Manufacturing Slump

Elevated global trade tensions, particularly between the U.S. and China, have led to significant weakness across the global manufacturing sector since early-2018. Thankfully, most global service sector gauges remain in expansionary territory, with the U.S. Services Purchasing Manufacturer’s Index coming in at 56.4 for August. It is important to remember that the U.S. economy is a consumer based economy and manufacturing comprises a relatively small share of overall U.S. GDP as shown in the chart below.

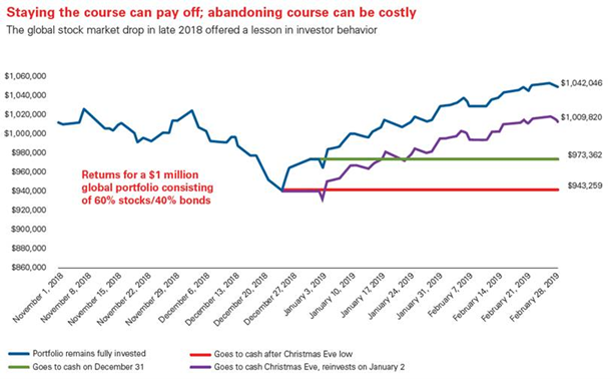

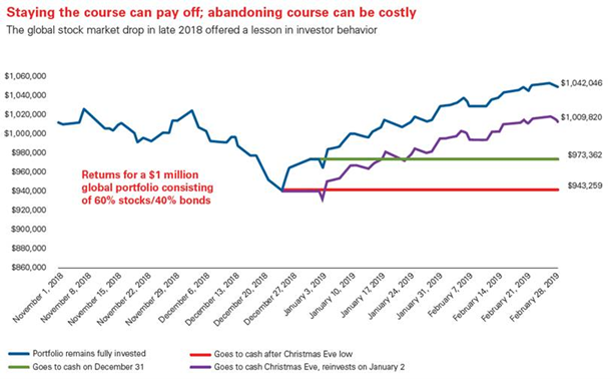

Staying Invested

Staying invested in times of market stress is illustrated here. The chart shows different dates an investor could have switched their portfolio to cash in the late 2018 correction. The outcome that resulted in the highest ending balance was staying invested.

Tariff Start Date Change

Tariffs on consumer products were pushed back to commence September 1st and December 15th for different product categories. To this point, tariffs on China have not been necessarily on broad categories of consumer products as the ones coming up are set to be. U.S consumers would likely notice higher prices should these tariffs go into effect.

Rate Cut

The Federal Reserve lowered their target rate for the first time since 2008. Each of the two last times that interest rates were cut, a recession and many more rate cuts followed. This time, the U.S economy is strong on its own but global threats loom overhead.

Consumer Impact

The next round of tariffs that have been threatened by President Trump will have the most impact on consumer goods.

Trade War

With little progress being made on ending the trade war, imports of U.S. soybeans by China have dropped to the lowest level since 2004 at just over 5 million tons. To put this in context, China imported soybeans at a rate of 3.2 million tons a month in the first half of 2017.

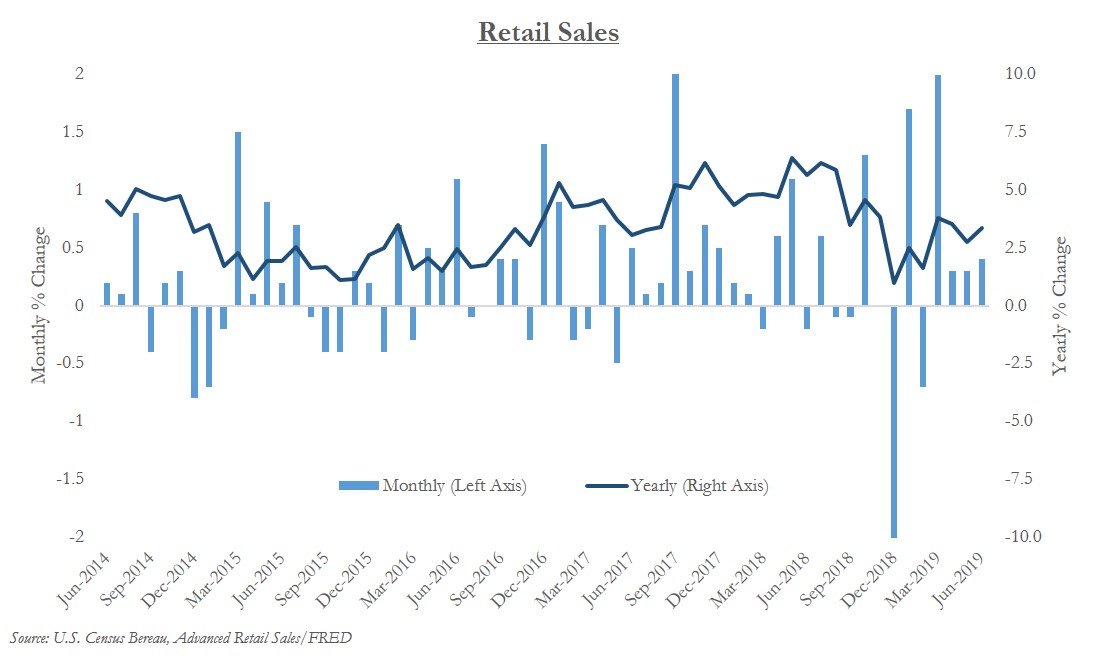

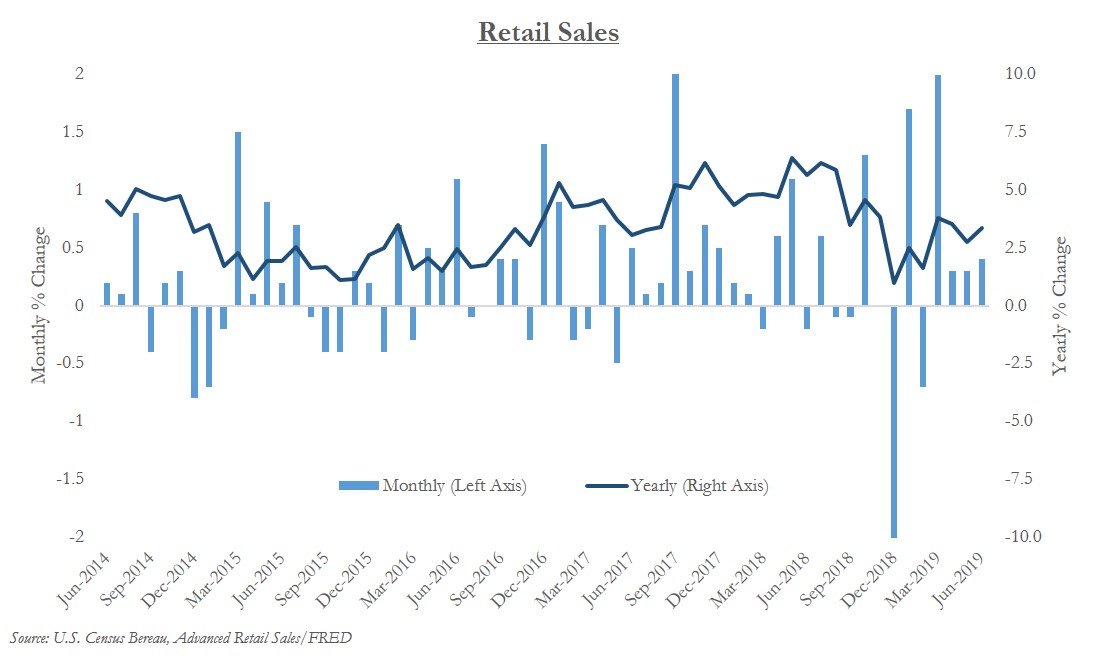

Strength in Retail Sales

Another sign of strength by the U.S. consumer was revealed in the Retail Sales report showing retail sales rising for the fourth consecutive month. The Retail Sales report covers the durable and nondurable portions of consumer spending and highlighted the broad based spending across categories by the consumer.

Consumers Remain Strong

Consumer spending is estimated to grow at a 4.3% annual rate in the second quarter – the fastest pace since 2014 – according to forecasting firm Macroeconomic Advisers. The U.S. is a consumer based economy – with consumption accounting for approximately 70% of economic growth. The strong growth in spending bodes well for continued expansion in the second half of 2019 and into 2020.

Earnings Forecasts Continue to be Revised Down

Earnings headwinds have been plentiful – stronger dollar, lower oil prices and continued uncertainty regarding trade to name a few. More than 80% of S&P 500 companies that have revised their profit estimates one way or the other in the lead-up to reporting have slashed them, data compiled by Bloomberg show. Analyst estimates now call for a 2.5% drop in earnings for the second quarter. Unless companies exceed analyst earnings estimates, this would mark the first profit contraction in three years.

Economic Data for Eurozone Surprising to Upside

The IHS Markit Eurozone composite purchasing managers’ index (PMI) – used to gauge the direction of economic trends in the manufacturing and service sectors - strengthened to 52.2 in June, up from 51.8 in May, for the Eurozone. June’s PMI reading is the highest level since November 2018, signaling a pick-up in economic growth for the area. Most of the growth was driven by expansion in the services sector; helping to offset the downturn in manufacturing activity that continues to be dampened by tariff threats.

U.S. – China Trade Tensions

Consumer items have largely been spared by tariffs thus far into the trade war. Should the U.S. proceed with imposing tariffs on an additional $300 billion, there will be few items spared as illustrated in the change from current percentage of imports subjected to tariffs on the left to the percentages on the right under the proposed increase in tariffs.

Inflation Expectations

University of Michigan’s Survey of Consumers for June showed that survey respondents voiced concerns over tariffs, which may negatively impact growth and inflation. The 5-10 year inflation estimate from the survey declined to 2.2%, the lowest on record.

Leading Economic Index

The Conference Board’s Leading Economic Index (LEI) level increased to a new cycle high through April. However, annualized growth in the index slowed to 2.7% - the weakest growth rate since 2017. A further slowdown in the rate of improvement bears watching.

U.S. – China Trade Tensions

Trade tensions between U.S. and China have been renewed as the U.S. increased tariffs to 25%, from the previous rate of 10%, on $250 billion of Chinese imports last Friday. Tech-related imports are facing the largest impact from the increased tariffs.

Economic Growth in the U.S.

Economic growth in the U.S. – as measured by Gross Domestic Product (GDP) – beat estimates by a wide margin in the 1st quarter as the economy expanded at an annualized pace of 3.2% for the quarter versus the 2.3% Bloomberg consensus estimate. Contributions to growth were experienced across each major category of GDP.

Rebound In Corporate Earning Revisions

Analysts became extremely pessimistic on their outlook for earnings growth in the midst of the 2018 market selloff; with downward revisions to their earnings growth estimates throughout the fourth quarter. With a majority of companies exceeding estimates for first quarter earnings across the globe, analyst are now revising their pessimism and therefore earnings outlook.

Manufacturing Activity Stabilizes in Asia for March

China led a rebound in manufacturing activity across Asia during March. The IHS Markit manufacturing purchasing managers’ index rebounded to 50.5 from 49.2 for China – the largest increase since 2012. Levels above 50 indicate expansion. Additional evidence is needed to confirm whether or not the economies across Asia are stabilizing.

Economic Growth Cools Down in the Final Quarter of 2018

Fourth quarter GDP growth was revised down from the initial 2.6% estimate to 2.2% as government and consumer spending were less than originally estimated. This final estimate for the fourth quarter brings economic growth for the full year of 2018 to 3%; the fastest pace since 2005.

The Yield Curve Inverts

On March 22nd, the yield on the U.S. 10-year Treasury note dipped below the yield on the three-month paper. While an inverted yield curve often precedes a recession, not all inverted yield curves lead to a recession. Furthermore, while it may be a recessionary signal, it tells us nothing about the timing of such recession. See Legacy’s Insight Piece, “Inversion of the U.S. Bond Yield Curve” for additional commentary.

Market-Projected Rates Diverge from Fed Projected

In February, Fed Chair Jerome Powell reiterated the case for a patient interest-rate policy given “muted” inflation pressures and slowing global growth as a risk to their outlook. The market now expects zero hikes in 2019 relative to the Fed’s projection of two hikes in 2019.

Rekindling the US – European Trade Dispute

U.S. and European differences over agriculture threaten to rekindle a tit-for-tat trade war as Congress and some Trump administration officials are demanding access to European markets following a trans-Atlantic trade truce in July.

Job Openings Rise to a Record High in December

Job openings increased to a record high of 7.335 million during the month of December and exceed the total number of unemployed persons (6.294 million) by more than 1 million positions.

Short-Term Cash Rates Now Yield More Than Inflation

For the first time since 2008, for the first time since early 2008, the three-month Treasury bill has a higher yield than the market’s expectations for inflation over the next 10 years.

Banking System Liquidity & Equity Valuations

In conjunction with the shrinking of the Federal Reserve’s balance sheet, there has been a significant decline in banking system excess reserves. The explosion in banking system liquidity has been noted as a key driver behind the equity market rally since 2009; the subsequent draining may limit equity returns going forward.

Rural America Feeling the Impact of Tariffs

Rural America has suffered a multiyear slump in prices for corn, soybeans and other commodities touched off by stiff foreign competition and a world-wide glut. Tariff retaliation from China, Mexico and elsewhere has further roiled agricultural markets and pressured farmers’ incomes.

Global Expansion

BlackRock's "US-China relations" macro risk indicator has been declining.

Global Expansion

The synchronized global growth story told throughout 2017 has decoupled as the percentage of countries in expansion drops below long-term average.

Equity Market Selloffs

Sharp selloffs – such as that experienced in the fourth quarter of 2018 – don’t have a great track record as a recessionary indicator.

Federal Reserve Rate Hikes

Rounding-out their 2018 Federal Open Market Committee (FOMC) meeting schedule, the Fed hiked the federal funds rate by 25 basis points (bps) at their mid-December meeting to an upper bound of 2.50%, the fourth hike of 2018 and the eighth hike in their current tightening campaign.

Global Asset Class Performances

2018 has proven to be a tough year for asset classes across the board. With 93% of global assets delivering a negative return year-to-date, 2018 is the worst year on record for this measure.

Stock Market Valuations

The S&P 500 Index’s Forward P/E ratio has hit multi-year lows as it remains in correction territory (down over 10% from record highs).

Companies Ramp Up Buybacks

Shares of several U.S. companies have rallied following recent announcements of increased share repurchases, a welcome development for investors bruised by recent market volatility.

Time in the Market more Important than Timing the Market

While some believe higher volatility brings better opportunities for market timing, such efforts face a high bar relative to just staying invested. Missing the best months in equities, which are often after drawdowns like those experienced in February and October of 2018, lowers holding period returns materially.

Valuation Across Asset Classes have Declined in 2018

Equity and credit valuations are below 1990s average levels again. Equity valuations have de-rated due to a combination of price declines and still positive earnings growth.

Equity vs. Bond Performance

For the first time since 2015, global equities have underperformed bonds in 2018 year-over-year.

Economic Growth Expectations

Economists expect third-quarter gross domestic product (GDP) to come in at a 3.4% annual growth rate this week. If met, this would add up to the best back-to-back quarters since 2014 following the second quarter’s +4% growth rate.

Job Openings Spike to Record

Through August, the number of job openings increased to the highest on record, at 7.136 million. There are approximately 1.2 million more job openings than unemployed persons, potentially indicative of a lack of skilled available labor capital and/or a skills mismatch inherent in the labor force

Earnings Season Could Help Provide Bottoming Process from Recent Selloff

The benchmark S&P 500 index has risen in seven of the past nine earnings seasons, climbing on average 1.7% during the four weeks after big banks kick off the reporting period, according to Dow Jones Market Data. Even more encouraging is that in three of those periods, the S&P 500 had fallen in the four weeks leading up to earnings season. In other words, it’s not unusual for the equity markets to go through a period of weakness before earnings season. With analysts projecting a 21% growth rate in earnings for the third quarter, we expect this trend to continue.

Real Growth Expectations, not Inflation Expectations, Pushing Nominal Yields Higher

Nominal yields jumped on Wednesday with the 10-year U.S. Treasury yield touching 3.23%, a significant 14bp move in a 24-hour period. After retreating slightly, at time of writing yields have moved higher again reaching 3.24%, their highest level since February 2011

U.S. Economy Begins to Disappoint Lofty Expectations

The U.S. economy is growing at the quickest pace in over four years and, therefore, keeps raising the bar for economist’s expectations. The Citigroup Economic Surprise Index, a measure of whether economic reports are meeting projections, has fallen to its lowest level in nearly a year in the U.S. The gauge has dropped into negative territory, indicating releases are broadly starting to come in below expectations. At the same time, we are seeing a rebound abroad where expectations have been depressed.

Economic Growth: U.S. GDP - Quarterly Growth Rate

The U.S. economy grew at the strongest pace in nearly four years during the second quarter. Gross domestic product (GDP) – the value of all goods and services produced across the economy – increased at a 4.1% annualized rate in the second quarter.

In Terms of Returns, however, the Current Bull Market Ranks only 8th

The pure duration of the bull run is impressive but not particularly surprising given the magnitude of the recession that the U.S. has rebounded from. From a return perspective, however, the bull market currently ranks in 8th place in terms of annualized returns.

The Current Bull Market has Become the Longest One on Record

The current bull market began on March 9th, 2009 when the S&P 500 was as 676 points. 9 ½ years and 323 percent later, the S&P 500 officially set the record for the longest bull market run on Wednesday. With double digit earnings growth paired with strong economic growth, there should be room for it to extend this record.

Emerging economies may remain susceptible to appreciating US Dollar (USD)

Trade war concerns, continued tightening of U.S. monetary policy, and more recently an appreciating USD, have weighed on emerging market assets in 2018. Continued USD strength may complicate government funding for those economies that rely heavily on external debt to finance their economy. Across the emerging markets, the IMF estimates that external debt total servicing costs are near 10% of GDP, which, is above long-term average levels, but below peak levels witnessed in 2015

Consumer Spending Remains Strong

With a strong second quarter growth rate, investors are now turning their attention to the third quarter. Retail sales, released last week, provide a good omen with a strong 0.5% monthly growth rate; suggesting consumers remain healthy which should provide continued support for economic growth

Conference Board LEI & Business Cycles

Conference Board Leading Economic Index (LEI) data for June was released last week and showed that the LEI increased 0.5% month-over-month. The index level increased to 109.8 in June, a new cycle high. As the name of the index suggests, this composite of indicators is designed to lead the business cycle, with recent solid growth supportive of near-term economic gains and implying a business cycle still exhibiting an expansionary bias.

Broad Strength

Broad strength across all sectors are expected for second quarter earnings season with Energy leading the way.

Escalating Earnings

Rallying oil prices, strong U.S. economic data and buoyant consumer confidence have pushed analysts’ earnings estimates higher since the start of the second quarter.

The U.S.-China tariff war and the S&P 500

Equity markets continue to be conflicted between the benefits of tax reform and the turbulence of tariffs.

Contribution to S&P 500's Gain

Just four stocks have fueled over 82% of the S&P 500’s 2.6% gain on a year-to-date basis through June 30th. Excluding these stocks, the S&P 500 would only be up 0.48%. Excluding the top seven stocks, the S&P 500 would be in negative territory for the year. During an average year, the 10 stocks with the greatest impact typically account for only 45% of the market’s price moves.

US Effective Tariff Rate

The proposed tariffs - if implemented in full - would increase the average effective US tariff rate by about 5 percentage points (pp) and take the US back to levels last seen in the 1970s.

Total US Imports Affected

Counting the tariffs. So far, duties on $55.7 billion of imports have been implemented, including tariffs on washing machines and solar panels, steel and aluminum. A first round of tariffs on $34 billion of imports from China is set to take place on July 6th unless an agreement is reached. From here, President Trump has threatened three further steps: a 25% tariff on an addition $100 billion from China, 20% on $275 billion of auto imports and 10% on an additional $300 billion from China.

June - 2018 Fed Hike Probability

The Federal Open Market Committee will be announcing their next policy decision tomorrow. Another rate hike is nearly fully priced into the markets with a probability of 84%.

Evaluation of Atlanta Fed GDPNow real GDP Estimate For 2018: Q2

The Atlanta Fed’s GDPNow model forecast for second quarter economic growth remains above 4.5%. Even if the model is overestimating growth by 1%, the second quarter is staging an impressive rebound.

Economic Policy Uncertainty Remains Elevated

Politics continue to cause uncertainty and angst for the markets as they dominate the headlines. Most recently, the announcement of new governments in Italy and Spain and the implementation of steel and aluminum tariffs on some of our largest trading partners, including Canada, Mexico and the European Union.

Cumulative Rate Hikes

While the Federal Reserve is increasing interest rates in the U.S., this rate hiking cycle is set to be the longest and shallowest on record.